Follow us on LinkedIn

If you’re wondering what you need to know about 760 credit scores, you’re in the right place. A credit score of 760 is considered excellent and will allow you to get the best interest rates on mortgages, car loans, and other types of financing. In this blog post, we will discuss what goes into a credit score and how you can work to improve your score if it’s not at 760 yet. We’ll also provide some tips on how to maintain your excellent credit rating.

What does a credit score of 760 mean?

A credit score is a number that lenders use to determine your riskiness as a borrower. The higher your score, the lower the risk you pose to lenders and the better interest rates you’ll be offered. A score of 760 or above is considered excellent and will get you the best interest rates possible on loans.

There are a few things that go into your credit score, including your payment history, the amount of debt you have, the length of your credit history, and more. You can improve your score by paying your bills on time, maintaining a low level of debt, and using a mix of different types of credit.

How much can you borrow with a 760 credit score?

If you have a credit score of 760, you can borrow a significant amount of money from lenders. You’ll be offered the best interest rates available, and you’ll likely be approved for any loan you apply for. The amount you can borrow will depend on your income, debts, and other factors, but a good credit score will give you the ability to borrow a large sum of money.

Tips for maintaining a 760 credit score

Once you’ve reached an excellent credit score, it’s important to maintain it. You can do this by paying your bills on time, keeping a low level of debt, and using a mix of different types of credit. By following these tips, you can ensure that your score stays high and you continue to get the best interest rates available.

Should I try to improve my credit score if it’s already excellent?

If your credit score is already excellent, you don’t need to try to improve it any further. You’ll already be getting the best interest rates available, and you won’t be at risk of losing your excellent credit rating. However, if you’re planning on applying for a mortgage or another large loan, you may want to try to improve your score even further to get the best terms possible.

The bottom line

If you’re looking to improve your credit score or maintain an excellent rating, 760 is the goal you should aim for. A score of 760 or above will get you the best interest rates on loans and help you borrow a large amount of money. To maintain a high credit score, pay your bills on time, keep a low level of debt, and use a mix of different types of credit.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES FOR DISSEMINATION IN THE UNITED STATES TORONTO — Silver Storm Mining Ltd. (“Silver Storm” or the “Company“) (TSX.V: SVRS | FSE: SVR), is pleased to announce that it is further increasing the size of…

One past auction winner now works for Buffett after spending $5.3 million two lunches.

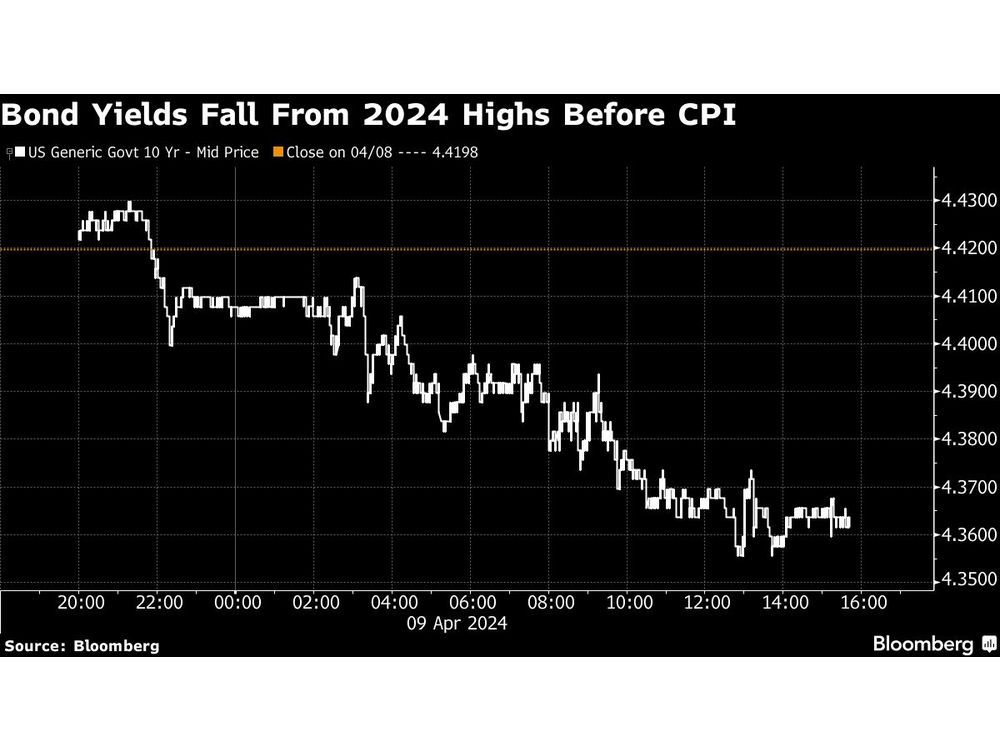

Stocks in Asia mostly pointed higher after US equities recovered and bonds climbed ahead of key inflation data that will help shape the outlook for the Federal Reserve’s next steps.

VANCOUVER, British Columbia, April 09, 2024 (GLOBE NEWSWIRE) — Amcomri Entertainment Inc. (“Amcomri” or the “Company”) (Cboe CA: AMEN) (Frankfurt: 25YO) (OTC: AMNNF) is pleased to announce that the Company has amended and restated its existing credit facilities. The Company amended and restated the agreements…