Follow us on LinkedIn

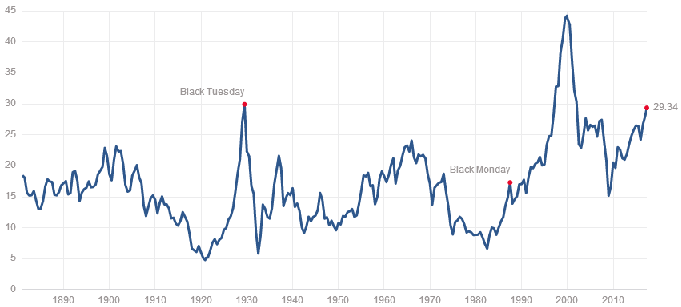

Last week, professor and Nobel Laureate Robert Shiller came out with a statement regarding the market high valuation. He referred to the CAPE ratio which is at 29 at the moment and is considered high. However, he also said that the high CAPE ratio does not necessarily mean investors should sell stocks right now.

Still, Shiller makes it clear this doesn’t necessarily suggest that investors should sell stocks.

“I’m not saying pull out of the market — I’m saying that it looks dangerous now,” the Yale economics professor said Wednesday on CNBC’s “Trading Nation.” “But it could keep going up.” Read more

Shiller PE Ratio as of May 3, 2017. Source: www.multpl.com/shiller-pe/

So the question is, once again, how can investors protect their portfolios at a reasonable price and still be able to participate on the upside?

One solution is to employ a hedging strategy such as the US Equity Portfolio Enhancement Trade that uses listed options.

Another solution is to use a proxy hedge. Such a solution was suggested recently by another academic giant, Jeremy Siegel.

Prominent stock-market bull Jeremy Siegel says the best bet in a severe market downturn may be owning 30-year, U.S. government paper.

“And don’t forget, the long bond is the ultimate hedge against a stock-market crash. If there’s going to be a bad event internationally, North Korea, Europe or whatever, everyone runs to the long bond,” the University of Pennsylvania economist and professor of finance at the Wharton School of Business told CNBC during a Monday interview.

“It’s an insurance policy, it gives [the bond] a premium and a premium means a low yield on that instrument,” he said. “If something happens, they will go up if the stock market goes down 500 points.” Read more

Right now, investors appear fearless as they are pouring money into equities. But they have forgotten that hedging is like buying insurance. And the best time to buy insurance is when we don’t need it. When the house catches fire, it will be too late to buy an insurance policy, or we have to pay an exorbitant price for it.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum