Follow us on LinkedIn

In a previous post, we examined the relationship between the Credit Default Swap (CDS) and equity volatility, and argued that there is a strong correlation between them. But like any relationship in financial markets, this one can break down and divergence can happen.

For instance, last month we noticed that CDS in Asia and Australia tightened considerably with respect to their US counterparts. Bloomberg actually reported:

Credit-default swaps on the bonds of every Asian emerging market except for South Korea have tumbled this year, outperforming debt risk for the U.K. and for France, which has jumped amid the presidential election campaign. Inflows into developing Asian bond markets have also swelled in 2017 as investors bet the world’s fastest-growing region will be able to better withstand the volatility and outflows unleashed by a tightening Federal Reserve.

“Emerging Asia scores relatively well on both macro as well as political stability and is likely to remain an attractive region to invest in for the foreseeable future,” said Anders Faergemann, a senior fund manager in London at PineBridge, which manages about $83 billion globally. “The short-term risk is mainly associated with external factors as the markets fear the Fed is behind the curve.” Read more

This tightening of CDS in Asia presented an interesting trade opportunity. Indeed, Asia Unhedged pointed out:

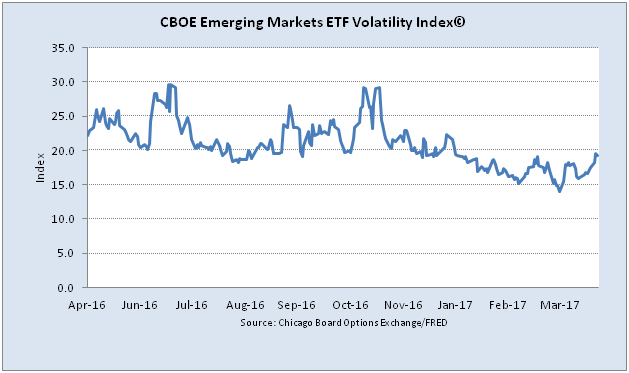

The difference between emerging market (EM) and US corporate BBB Option-Adjusted Spread is at an all-time low. The difference between EM volatility and VIX is around the average. This chart begs the question: Is there a trade in shorting credit and buying equity? Read more

This means that the EM CDS is relatively low with respect to the US counterpart when taking the volatility differential into account. The post also suggested going long EM equity and short its CDS.

So this is an example of divergence. But it’s important to note that it happens between the VIX and CDS differentials, i.e. it represents a dislocation between secondary risks, and not primary risks.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum