Follow us on LinkedIn

Volatility is a concept that is relatively well understood and used widely in the financial market. Correlation, on the other hand, is less understood. Nevertheless, it is used frequently in trading and portfolio management.

Correlation between 2 assets is a measure that shows the strength of the relationship between them. The correlation coefficient ranges from -1 to +1, where a correlation of +1 indicates that the assets move in perfect lockstep, while a correlation of -1 indicates that they move in opposite directions. The closer the correlation coefficient is to +1 or -1, the stronger the relationship between the assets. However, it’s important to note that a correlation coefficient of zero does not mean that there is no relationship between the assets; it just means that the relationship is weak.

How do we model the correlation?

At first, one would think that correlation can be modeled easily. But this is actually not the case. The following discussion on StackExchange pointed out,

Correlations are notoriously unstable in financial time series – yet one of the most used concepts in quant finance because their is no good theoretical substitute for it. You could say theory is not working with it yet neither without it.

For example the concept is used for diversification of uncorrelated assets or for the modelling of credit default swaps (correlation of defaults). Unfortunately when you need it most (e.g. a crash) it just vanishes. This is one of the reasons that the financial crises started because the quants modeled the cds’s with certain assumptions concerning default correlations – but when a regime shift happens this no longer works.

We agree with the author. Correlation is hard to model, and yet widely used in finance. Does anyone remember the financial crisis of 2008? Incorrect modeling of correlation played a big part in that crisis.

How do we choose non-correlated assets?

Unfortunately, it’s becoming harder and harder these days to find weakly correlated assets. Let’s take Bitcoin as an example. It used to be an alternative asset that was weakly correlated with the stock market. But the correlation has become stronger these days.

Maybe one should focus his efforts on finding non-correlated trading strategies?

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

GENEVA, March 31, 2024 (GLOBE NEWSWIRE) — Ambassador Nobel C.K. McWhorter & McWhorter Family Trust announce its strategic collaboration with Vacheron, an epitome of luxury watchmaking and the world’s oldest watch manufacturer in continuous operation. This partnership celebrates Vacheron’s unparalleled dedication to artisanal heritage, excellence,…

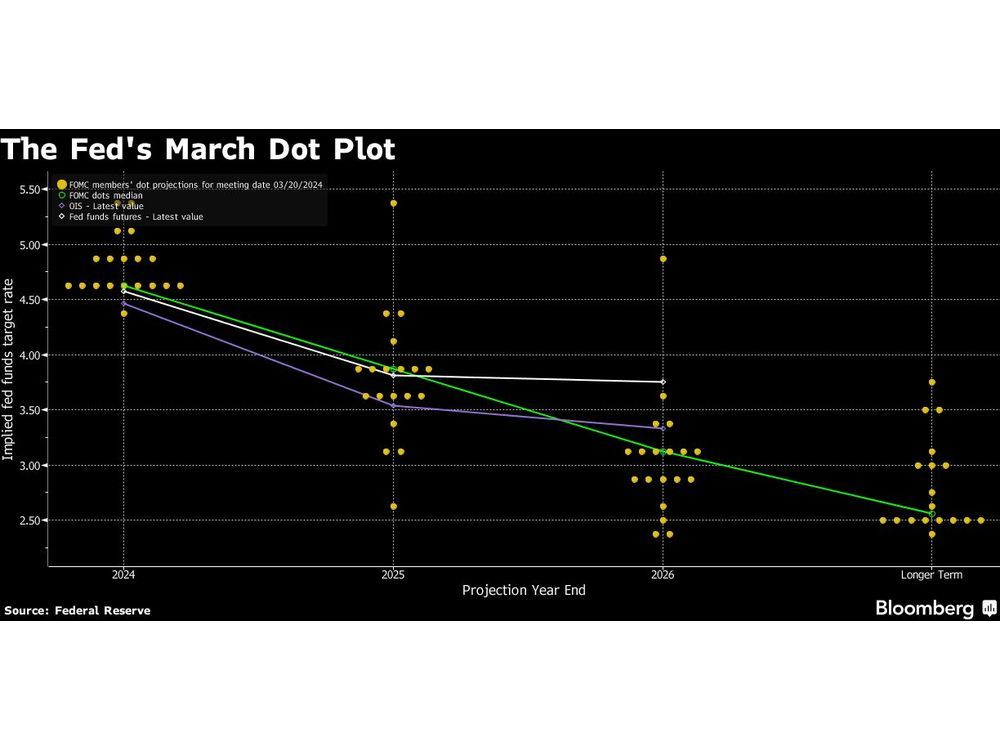

Equity markets in Asia look set to open higher as the Federal Reserve reiterated it’s in no rush to cut interest rates and will await more evidence that inflation is under control.