Follow us on LinkedIn

The overnight index swap (OIS) has come into the spotlight recently, due to the widening of the Libor-OIS spread. For example, the Economist recently reported:

WATCHING financial markets can be like watching a horror film. A character walks into the darkness alone. A floorboard creaks. The latest spooky sign is the spread between the three-month dollar London interbank offered rate (LIBOR) and the overnight index swap (OIS) rate. It usually hovers at around 0.1%, but has recently climbed to 0.6% (see chart). As it widens, bankers are bracing for a jump scare.

To see why, consider what each rate represents. LIBOR is the rate that banks charge other banks for unsecured loans. The OIS rate measures expectations for the federal funds rate, which is set by the central bank. As LIBOR rises above the OIS rate, that suggests banks fear it is getting riskier to lend to each other. (The gap was 3.65 percentage points in the depths of the crisis, after Lehman Brothers filed for bankruptcy.) Read more

Libor-OIS spread as at May 2, 2018. Source: Bloomberg

What exactly is an overnight index swap?

An overnight index swap is a fixed/floating interest rate swap that involves the exchange of the overnight rate compounded over a specified term and a fixed rate. The floating leg of the swap is related to an index of an overnight reference rate, for example Canadian Overnight Repo Rate Average (CORRA) in Canada or Fed Funds rate in the US.

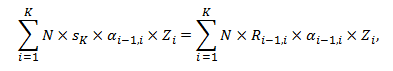

Usually, for swaps with maturities of 1 year or less there is only one payment. Beyond the tenor of 1 year, there are multiple payments at regular intervals. At the inception of the swap, the par swap rate makes the value of swap zero. That is, the net present value (NPV) of the fixed leg equals the NPV of the floating leg,

where N denotes the notional amount of the swap,

Ri-1,i is the forward OIS rate,

Zi is the discount factor at time ti

is the daily accrual factor, and

is the daily accrual factor, and

sK is the par swap rate of a swap with maturity tK.

The OIS discount factors (DF) are often used to value interest rate derivatives that require a posting of collateral. The OIS discount factor curve is built by bootstrapping from the short maturity and long maturity overnight index swap rates in order of increasing maturity. The processes for backing out the discount factors from the short and long maturity swap rates are, however, different.

In the short end of the curve, given that there is only 1 payment, the discount factor is calculated based on the spot rates. At the long end of the curve, the DF curve is determined as follows,

- Payment dates are generated at each 6 months (or a year, depending on the currency) from the time zero up to 30 years,

- Par swap rates are determined at each payment date. To obtain the par swap rates for the payment dates where there are no swap quotes, one linearly interpolates the par swap rates in order to complete the long end of the swap curve,

- Using the par swap rates at each payment date, discount factors are obtained by solving a recursive equation.

This is just an introduction to OIS discounting. The process for building an OIS discount curve involves many technical details. We are happy to answer your questions.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

Net Income Available to Ordinary Shareholders of $216 million and Operating Income of $98 million for the Three Months Ended Net Income Available to Ordinary Shareholders of $485 million and Operating Income of $368 million for the Twelve Months Ended Operating Return on Average Equity…