Follow us on LinkedIn

It happened again, and again.

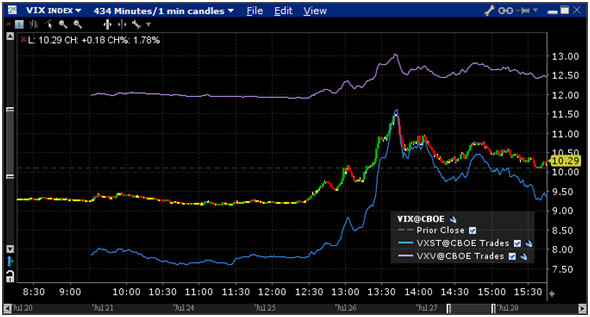

Last Thursday volatility increased sharply at around 1.30 p.m, then it came back to normal at the end of day. For now, we ignore the cause. But this event reinforced our observation: sharp volatility spikes occur more and more frequently these days.

Volatility on July 27, 2017. Souce: InteractiveBrokers

In a low volatility environment like this one, market participants are becoming more and more aware of the potential risks caused by the volatility feedback loop which will happen when the short volatility players are forced to deleverage. Sharp spikes in volatility are usually caused by unanticipated, black swan type of events. According to Steve Cucchiaro, the following circumstances can have the potential of leading to black swans

- Momentum is a principal reason why equities keep hitting new highs. Could this shift to momentum turn into a parabolic melt-up? If so, it could set the scenario for a black swan correction

- A record amount of money is shorting the primary volatility index, the VIX. What would happen if some event were to change this environment? There likely would be a ton of short-covering in the VIX, which could turn a minor correction into a major one.

- Kim Jung Un has been shooting off missiles in North Korea without consequence. Given that the North Korean regime appears irrational, who know what could happen. What if they “tried to take out our satellites?”

- Increasing tension between Iran and Saudi Arabia threatens to destabilize more than the Middle East.

- Gridlock in Washington looks worse than ever.

- A major cyber-attack on our infrastructure, electrical grid or financial system has become a larger risk. Hackers are getting more sophisticated and their ability wreak havoc is rising.

- The profits recession of 2015 is over and corporate bottom-lines are throwing off record amounts of income. What if this is the last great quarter of corporate earnings for the current cycle?

- What about a bond market meltdown? After 35-year rally in bonds, interest rates remain near historic lows. Most major central banks are all trying to normalize on a synchronized basis. Read more

Nobody knows when a black swan will happen. So the right question to ask is: how to protect oneself from the black swan events?

We believe that using VIX options to construct ratio call spreads (for example 1×2 VIX calls) is a sensible solution.

We note that recently, Joe Ciolli of Business Insider presented an example of a hedge against a massive increase in volatility. But according to his post, we think that the trade is risky, so this is not a good hedge.

- To fund it, the investor sold 262,000 VIX puts expiring in October, with a strike price of 12.

- The trader then used those proceeds to buy a VIX 1×2 call spread, which involves buying 262,000 October contracts with a strike price of 15 and selling 524,000 October contracts with a strike price of 25.

- In a perfect scenario, where the VIX hits but doesn’t exceed 25 before October expiration, the trader would see a whopping $262 million payout.

- It is possible for the VIX to spike too much. If it increased beyond 35.2, the investor would start to lose money since they used a call spread, even though they got the direction of the trade correct.

- For context, VIX October futures are trading at 13.6, while the spot index closed at 9.62 on Thursday. Read more

Alternatively, the trade was constructed and executed correctly, but it was misinterpreted by the journalist.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum