Follow us on LinkedIn

Every investor in the market has an investing strategy that helps them maximize their returns. These strategies are usually flexible and differ according to the investor’s risk tolerance, financial situation, budget, etc. Investors can either use a single strategy or a combination of various strategies to achieve their goals. One of the investing strategies commonly used by investors is market timing.

What is Market Timing?

Market timing is an investment strategy through which investors make investments in asset classes based on predictive methods. With this strategy, investors have to make assumptions about what a security price will be at a future time. Investors can either speculate on the prices rising or falling in the future.

Market timing represents the predictions made by investors about security price movements. Using market timing, investors can speculate on when a stock or security’s price will move. This way, they can invest according to their speculation to profit later if it turns out to be true. The aim of this strategy is to outperform the market by taking a long or short position.

How does Market Timing work?

The market timing strategy starts from a prediction that investors make. Investors can select a stock and predict whether its price will increase or decline in the future. There are several tools that investors may use to reach a conclusion about the prediction. Once an investor makes a prediction, they can invest in the selected stock and security.

There are two investment positions that investors can take in a market timing strategy. It may include a long position, where an investor buys the security or stock. This approach works when the investor believes the price of the selected instrument will increase in the future. Instead, investors may also take a short position to sell the stock or security. This approach works when the investor predicts the price to fall in the future.

What are the advantages and disadvantages of the Market Timing strategy?

The most prominent advantage of using the market timing strategy is the return investors get. Investors can earn significantly more with this strategy, given that they can make the correct predictions. This strategy also allows investors to make profits at a quicker rate compared to other strategies. The market timing strategy is riskier. However, the higher returns that investors get can offset the risks undertaken.

However, the market timing strategy requires more effort from investors. Investors need to track market behaviour and trends continuously to identify future positions. Similarly, due to the higher risks, this strategy can expose investors to high losses. Furthermore, investors have to pay higher taxes due to the short-term nature of these investments.

When should investors use the Market Timing strategy?

The market timing strategy isn’t for everyone. This strategy is only beneficial for experienced investors that can identify market trends and patterns and make predictions accordingly. For novice investors, the market timing strategy is attractive due to the high rewards it promises. However, it also has the potential to cause significant losses.

Conclusion

Market timing is a strategy that investors use to make predictions on future stock or security prices. Using these predictions, investors can either buy or sell the selected stock or security in the market. The market timing strategy can be highly profitable if used correctly. However, it can also result in substantial losses. This strategy is best if used by experienced investors.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

GENEVA, March 31, 2024 (GLOBE NEWSWIRE) — Ambassador Nobel C.K. McWhorter & McWhorter Family Trust announce its strategic collaboration with Vacheron, an epitome of luxury watchmaking and the world’s oldest watch manufacturer in continuous operation. This partnership celebrates Vacheron’s unparalleled dedication to artisanal heritage, excellence,…

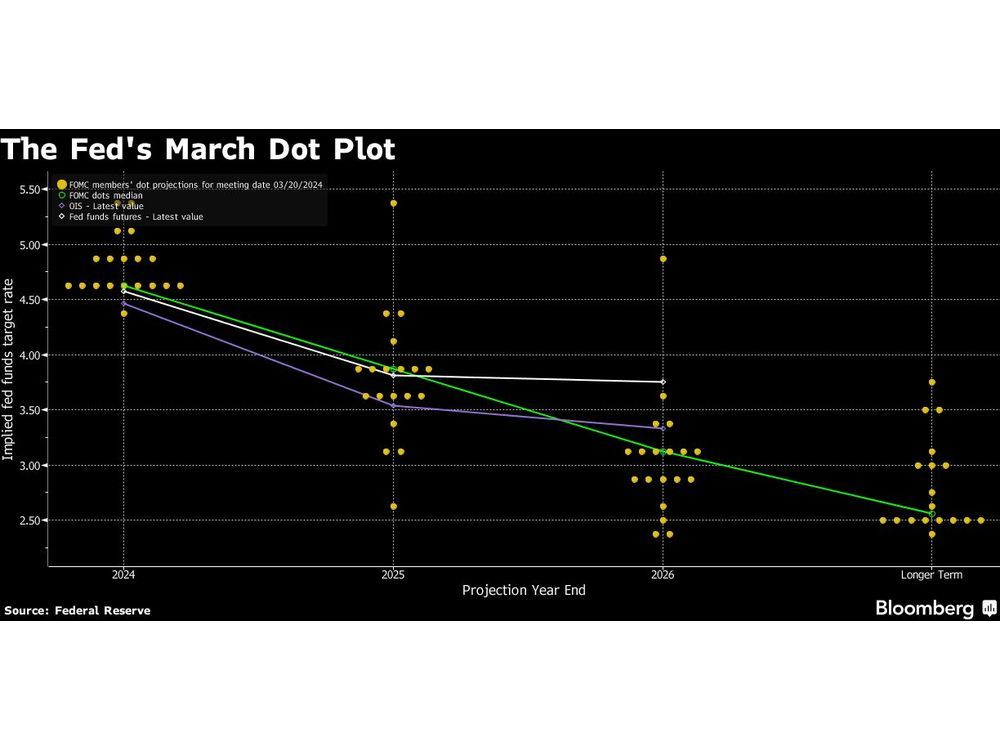

Equity markets in Asia look set to open higher as the Federal Reserve reiterated it’s in no rush to cut interest rates and will await more evidence that inflation is under control.