When you need money, the first thing you probably think about is how much it will cost you. The cost of borrowing money can be high, but there are ways to reduce it. In this blog post, we will discuss the different costs associated with borrowing money and how to minimize them. We will also talk about some of the benefits of borrowing money and how to choose the right loan for your needs.

What are the costs of borrowing money?

The first thing you need to consider when borrowing money is the interest rate. This is the amount of money that you will be required to pay back in addition to the original loan amount. The interest rate can vary significantly depending on the type of loan and the lender. For example, a credit card may have an interest rate of 15% while a personal loan from a bank may have an interest rate of only 12%.

The next thing to consider is the fees associated with the loan. These can include origination fees, late payment fees, and prepayment penalties. It is important to compare the total cost of the loan including all of these fees before you decide which one is right for you.

Finally, you need to think about the repayment terms of the loan. Most loans have a fixed interest rate and a set repayment schedule. However, some loans may offer variable interest rates or allow you to make extra payments without penalty. It is important to understand all of the terms and conditions before you agree to borrow money.

How to reduce the cost of borrowing money

If you are considering borrowing money, there are a few things you can do to reduce the cost. First, shop around and compare interest rates and fees from different lenders. Second, try to get a loan with a fixed interest rate so you know exactly how much your payments will be each month. Finally, make sure you understand the repayment terms and conditions before you sign any paperwork.

Taking out a loan can be a big decision, but it doesn’t have to be a costly one. By doing your research and shopping around, you can find a loan that is right for you at a price you can afford.

FAQs

Is the interest rate the cost of money?

The interest rate is the amount of money that you will be required to pay back in addition to the original loan amount. The interest rate can vary significantly depending on the type of loan and the lender.

What are some benefits of borrowing money?

Some benefits of borrowing money include the ability to purchase a large item such as a car or home, consolidate debt, or make home improvements.

How do I choose the right loan for me?

The best way to choose the right loan for you is to compare interest rates and fees from different lenders. You should also consider the repayment terms and conditions before you agree to borrow money.

What are some things I should avoid when borrowing money?

Some things to avoid when borrowing money include taking out a loan you cannot afford, not shopping around for the best interest rate, and not understanding the repayment terms.

How do you borrow money from the bank?

The best way to borrow money from the bank is to compare interest rates and fees from different lenders. You should also consider the repayment terms and conditions before you agree to borrow money.

What is the best way to reduce the cost of borrowing money?

The best way to reduce the cost of borrowing money is to shop around and compare interest rates and fees from different lenders.

Is there a cost of borrowing money from a credit card?

Yes, there is a cost of borrowing money from a credit card. The interest rate can vary significantly depending on the type of loan and the lender.

What is the average interest rate for borrowing money?

The average interest rate for borrowing money can vary depending on the type of loan and the lender. However, the average interest rate for a personal loan from a bank is 12%.

The bottom line

Borrowing money can be a costly proposition, but it doesn’t have to be. By doing your research and shopping around, you can find a loan that is right for you at a price you can afford. Remember to consider the interest rate, fees, and repayment terms before you agree to borrow money. With a little bit of planning, you can make sure that the cost of borrowing money is manageable and fits into your budget.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

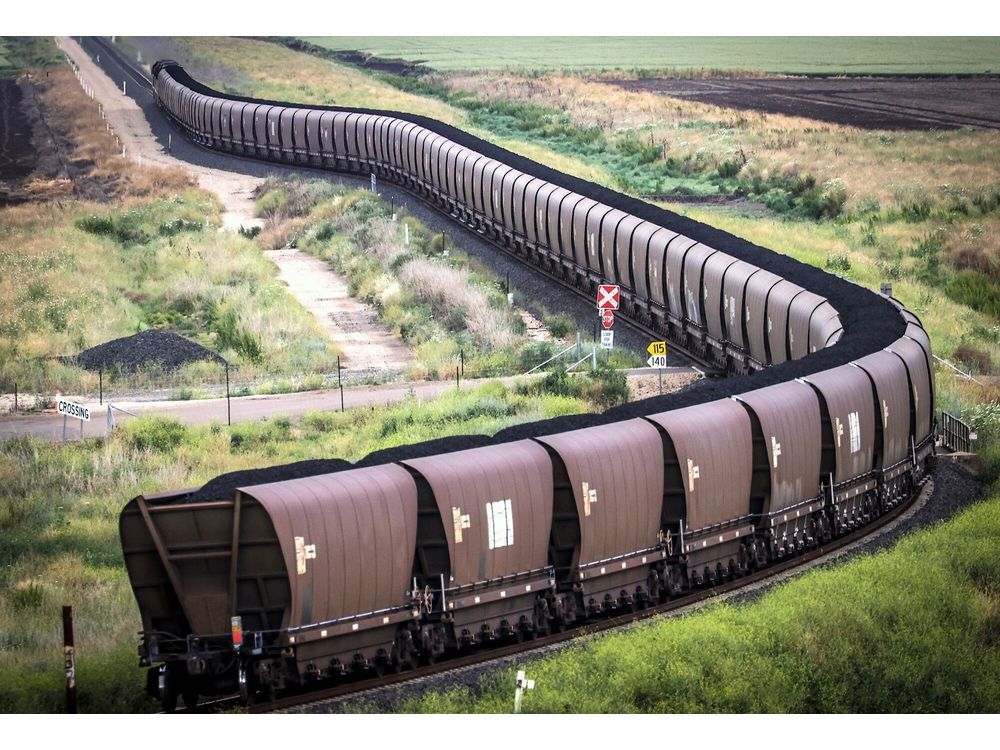

Australia’s new targets for carbon emission cuts by 2035 are expected to be delayed by several months as a result of Donald Trump’s return to the White House, likely pushing them out beyond the next election which is due to be held by May.