What is a Personal Balance Sheet?

A personal balance sheet is a financial statement that provides a snapshot of an individual’s financial situation by presenting their assets, liabilities, and net worth at a specific point in time. It provides a comprehensive overview of what a person owns and owes and their financial standing. Primarily, it follows the same format and principles as a business balance sheet.

A personal balance sheet provides individuals with a clear picture of their monetary resources, debts, and net worth. It is an essential tool for assessing financial progress, planning future goals, making informed financial decisions, and tracking changes in personal wealth over time. However, it doesn’t follow specific accounting standards applicable to businesses and companies.

What does a Personal Balance Sheet include?

A personal balance sheet includes the same components that are a part of the typical one. As mentioned above, these consist of assets, liabilities, and net worth (or equity). For individuals, the definition or elements may differ as below.

Assets

Assets for individuals include items of value that they own. They can encompass various categories, such as the following.

- Cash and cash equivalents: Money held in checking and savings accounts or cash on hand.

- Investments: Stocks, bonds, mutual funds, real estate properties, or other investment holdings.

- Property: The value of real estate, vehicles, or any other tangible assets.

- Personal possessions: Valuable items like jewelry, artwork, collectibles, or other valuable assets.

Liabilities

Liabilities for individuals represent the debts or financial obligations they have accumulated in the past. These can include the following.

- Loans: Outstanding balances on mortgages, car loans, student loans, personal loans, or any other borrowed funds.

- Credit card debt: Unpaid balances on credit cards or lines of credit.

- Other debts: Unpaid medical bills, taxes owed, or any other financial obligations.

Net worth

Net worth is similar to shareholders’ or owners’ equity. Individuals can calculate it by subtracting the total liabilities from the total assets. It represents the individual’s overall financial position and indicates wealth or financial standing. A positive net worth suggests that assets exceed liabilities, while a negative net worth indicates the opposite.

What is the Personal Balance Sheet format?

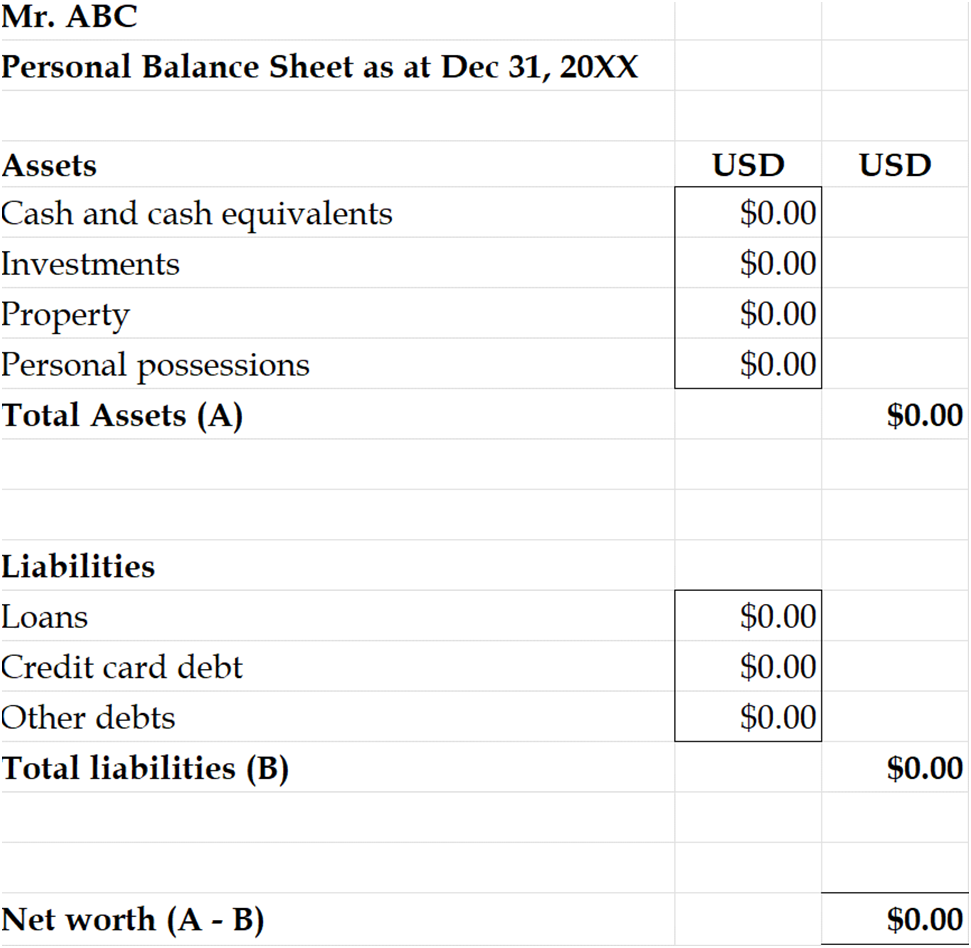

The personal balance sheet does not have a specific format. Individuals may use any template they want. However, it must follow the principle that the net worth represents the difference between assets and liabilities. An example of the personal balance sheet format is as below.

A personal balance sheet example, template in Excel

Why should individuals prepare a Personal Balance Sheet?

Preparing a personal balance sheet is critical for individuals as it provides a comprehensive assessment of their financial situation. It allows individuals to evaluate their assets, liabilities, and net worth, enabling them to understand their financial health. With a personal balance sheet, individuals can set financial goals, create effective budgeting strategies, and manage their debts more efficiently.

Furthermore, a personal balance sheet provides transparency and documentation of an individual’s financial position. By regularly updating and reviewing their personal balance sheet, individuals can make adjustments, optimize their asset management, and ensure they are on track to meet their financial objectives.

Conclusion

A personal balance sheet shows an individual’s financial health and position at a specific date. It includes assets, liabilities, and equity, shown as net worth. Primarily, this balance sheet shows how much an individual is worth based on the difference between his assets and liabilities. However, it does not follow a specific format or template.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum