Follow us on LinkedIn

A 520 credit score is considered a poor credit score. If you have a 520 credit score, you will likely have difficulty getting approved for a loan or line of credit. You may also be charged high interest rates and fees. However, there are some things that you can do to improve your credit score. In this blog post, we will discuss what a 520 credit score means and how to improve your credit rating.

What does a credit score of 520 mean?

A credit score of 520 is considered “poor” by most lending standards. This means that if you’re looking to take out a loan, you may have difficulty getting approved. Additionally, a 520 credit score will likely result in higher interest rates and less favorable terms on any loans that you are approved for.

If you have a 520 credit score, there are some things that you can do to improve your credit rating. First, make sure that you keep up with all of your payments. This includes your rent, utilities, credit card bills, and any other debts that you may have. Second, try to pay down your debt as much as possible. This will help to improve your credit utilization ratio, which is a major factor in your credit score. Finally, make sure to keep updated on your credit report so that you can dispute any inaccuracies.

While a 520 credit score is considered poor, there are still some things that you can do to improve your credit rating. By following the tips above, you can work on rebuilding your credit and improving your chances of getting approved for loans.

How much can I borrow with a 520 credit score?

The amount that you can borrow with a 520 credit score will depend on the lender and the type of loan that you are applying for. In general, you will likely have difficulty getting approved for a loan with a 520 credit score. However, there are some lenders who may be willing to work with you if you have a solid plan for repaying the loan. If you are able to find a lender who is willing to work with you, the amount that you can borrow will depend on the lender’s requirements.

FAQs

Is 520 a poor credit score?

Yes, 520 is considered a poor credit score. This means that you may have difficulty getting approved for a loan or line of credit. You may also be charged high interest rates and fees.

Can you recover from a 520 credit score?

Yes, you can recover from a 520 credit score. In this blog post, we will discuss what a 520 credit score means and how to improve your credit rating.

Can I buy a house with 520 credit?

It is possible to buy a house with 520 credit, but it will be difficult to get approved for a mortgage. You may also be charged high interest rates and fees. It is important to work on improving your credit score before you apply for a mortgage.

What is the lowest credit score?

The lowest credit score is 300. A credit score of 300 is considered “very poor” by most lending standards. This means that if you’re looking to take out a loan, you will have difficulty getting approved. Additionally, a credit score of 300 will likely result in higher interest rates and less favorable terms on any loans that you are approved for.

Can I buy a car with a 520 credit score?

It is possible to buy a car with a 520 credit score, but it will be difficult to get approved for an auto loan. You may also be charged high interest rates and fees. It is important to work on improving your credit score before you apply for an auto loan.

How long does it take to build credit from 520 to 700?

The time it takes to build credit from 520 to 700 will depend on various factors, such as your payment history and credit utilization ratio. However, it is possible to improve your credit score within a few months by making on-time payments and paying down your debt. Additionally, you can dispute any inaccuracies on your credit report which may be dragging down your score. following the tips above, you can work on rebuilding your credit and improving your chances of getting approved for loans.

The bottom line

If you have a 520 credit score, there are still some things that you can do to improve your credit rating. By following the tips above, you can work on rebuilding your credit and improving your chances of getting approved for loans. However, it is important to keep in mind that a 520 credit score is considered “poor” and you may have difficulty getting approved for a loan. If you are able to find a lender who is willing to work with you, the amount that you can borrow will depend on the lender’s requirements. It is also important to work on improving your credit score before you apply for a loan so that you can get the best terms possible.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

TORONTO, April 29, 2024 (GLOBE NEWSWIRE) — Golconda Gold Ltd. (“Golconda Gold” or the “Company”) (TSX-V: GG; OTCQB: GGGOF) is pleased to announce the release of its financial results for the year ended December 31, 2023. All amounts are in United States dollars unless otherwise…

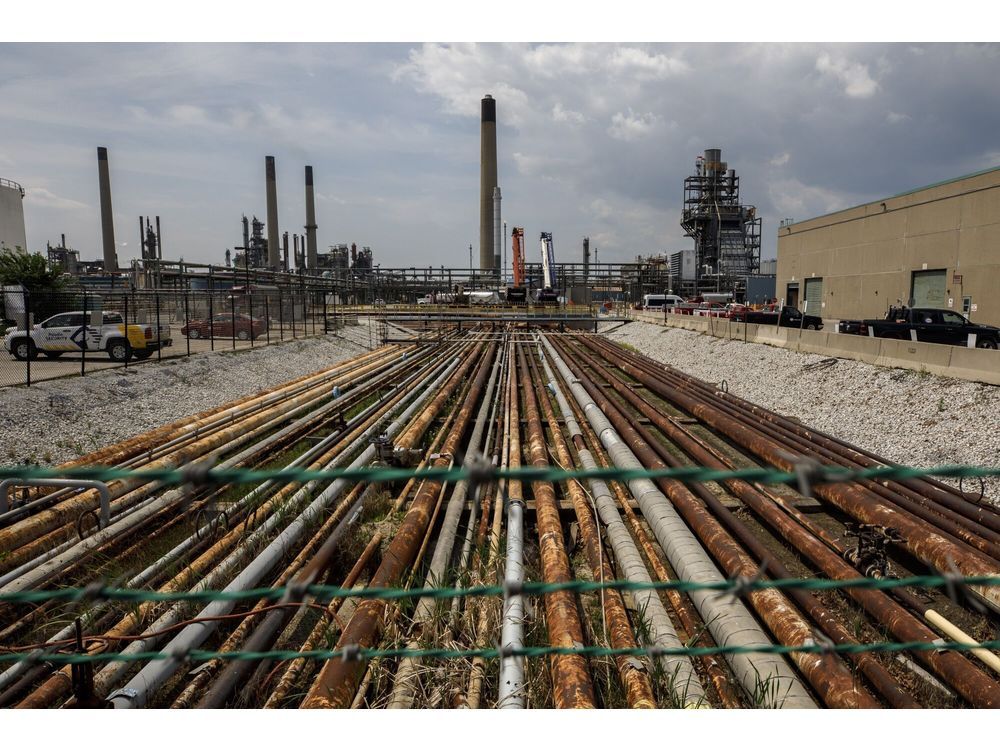

An indigenous community in Alberta’s oil-sands region submitted a proposal to Imperial Oil Ltd. shareholders that would require the company to disclose the financial effect of the energy transition.