Farmers all over the country rely on loans to get started and help them through tough times. There are many different types of loans available to farmers, and it can be difficult to know where to start. In this blog post, we will discuss the different types of loans available to farmers and how to go about getting the funding you need.

Types of loans available to farmers

The first step in getting a loan is to understand what type of loan you need. There are many different types of loans available, each with its own set of terms and conditions. The most common type of loan for farmers is the Agricultural Credit System (ACS) loan. This type of loan is available to farmers who are not able to obtain financing from traditional lenders. ACS loans are made through the Farm Service Agency (FSA), and they can be used for a variety of purposes, including farm operating expenses, crop production, and livestock purchases.

Another type of loan available to farmers is the Farm Storage Facility Loan (FSFL) program. This program provides low-interest loans to farmers who need to construct or upgrade storage facilities, such as grain bins or cold storage units. FSFL loans can be used for a variety of purposes, including farm operating expenses, crop production, and livestock purchases.

Getting the funding you need

Once you have decided what type of loan you need, the next step is to find a lender who can provide the funding you need. There are many different lenders who offer loans to farmers, and it is important to shop around to find the best deal. You can search for lenders online, or you can ask your local Farm Service Agency office for a list of lenders in your area.

When you have found a lender that you are interested in working with, the next step is to fill out a loan application. This process can vary depending on the lender, but it typically involves providing information about your farm, your financial situation, and what you plan to use the loan for. Once you have submitted your loan application, the lender will review it and decide whether or not to approve your loan.

If you are approved for a loan, the next step is to sign a loan agreement. This document will outline the terms of your loan, including the interest rate, repayment schedule, and any other conditions that apply. Be sure to read this document carefully before signing it, as it will be binding on both you and the lender.

Once you have signed your loan agreement, the lender will disburse the funds to you. You will then be responsible for making monthly payments on your loan until it is paid off. If you have any questions about your loan or the repayment process, be sure to contact your lender.

What to do if you can’t make your loan payments?

If you are having trouble making your loan payments, the first thing you should do is contact your lender. Many lenders have programs in place to help farmers who are struggling to make their payments. Your lender may be able to work with you to modify your loan agreement or provide other assistance.

If you are still having trouble making your payments, you may want to consider consolidating your loans or refinancing your loan.

Tips for managing your farm finances

The best way to avoid having to rely on loans is to manage your farm finances wisely. Here are a few tips to help you do just that:

-Create a budget and stick to it. A budget will help you track your income and expenses so that you can make adjustments as needed.

-Save money when you can. Putting money into savings will give you a cushion to fall back on if your farm experiences tough times.

-Diversify your income sources. Don’t rely on just one source of income for your farm. Consider diversifying into other areas, such as agritourism or value-added products.

By following these tips, you can help ensure that your farm is on solid financial footing. This will make it less likely that you will need to rely on loans to keep your farm running.

Closing thoughts

When it comes to loans, farmers have a lot of options available to them. By understanding the different types of loans and how to get the funding you need, you can make sure that your farm is on solid financial footing. With careful planning and management, you can avoid having to rely on loans altogether. However, if you do find yourself in a situation where you need to take out a loan, knowing your options can help you get the best deal possible.

If you have any questions about loans or farm finance, please contact your local Farm Service Agency office. They can help you explore all of your options and find the best solution for your farm.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

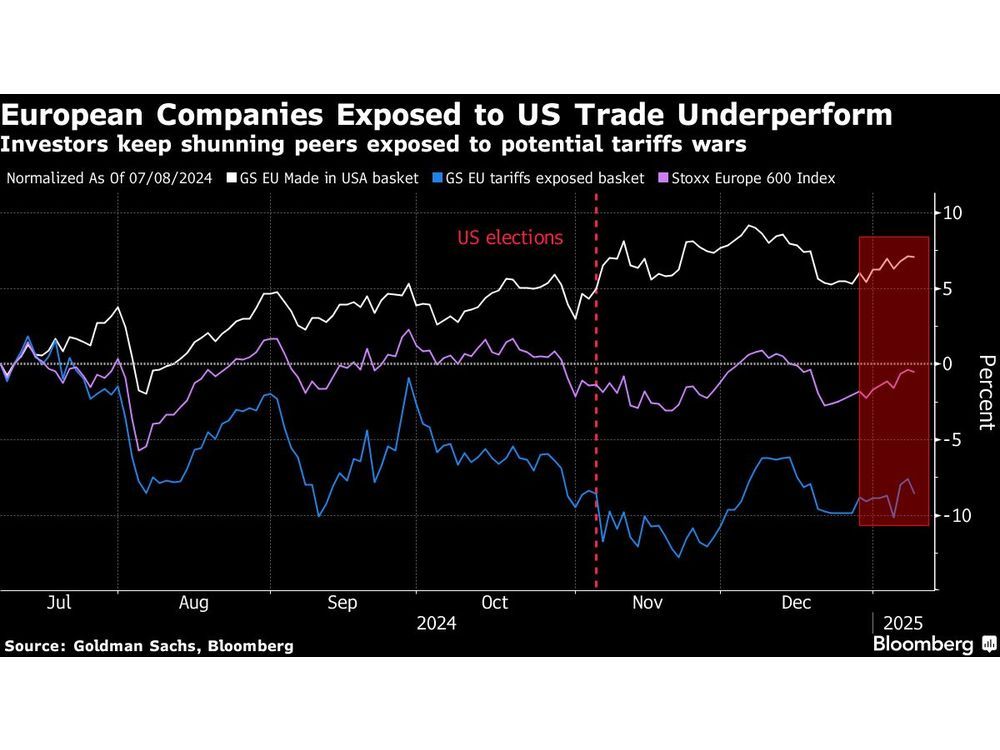

The UK’s domestically-focused index fell to the lowest since April on worries about fiscal deficit concerns and potentially higher inflation. The pan-European benchmark erased declines as investors also monitored the outlook for US trade policy.

Treasury vows to stick to its fiscal rules and says gilt markets functioning ‘in an orderly way’

Open a new bank account today and earn a top interest rate. Our experts have researched the best rates on checking, savings, and CD accounts to help you maximize your earnings.