Follow us on LinkedIn

Saving money can be difficult, especially if you don’t have a lot of extra cash to work with. One way to make it easier is to set up an automatic savings plan. This involves setting up a recurring transfer from your checking account to your savings account. This way, you don’t have to worry about remembering to save each month – the money will be transferred automatically! In this blog post, we will discuss the benefits of automatic savings plans and how to set one up.

What is an Automatic Savings Plan?

An automatic savings plan is a recurring transfer from your checking account to your savings account. The amount of money you choose to transfer each month and the frequency of the transfers are up to you. Most banks make it easy for customers to set up an automatic savings plan online or through their mobile app.

How does an automatic savings plan work?

When you set up an automatic savings plan, your bank will transfer a designated amount of money from your checking account to your savings account at regular intervals. This makes it easier for you to save because you don’t have to remember to put the money aside each month – it happens automatically! Your bank may also offer features such as setting up goals for yourself or tracking your progress.

Benefits of Automatic Savings Plans

There are many benefits to setting up an automatic savings plan, including:

- Convenience – Automatically transferring money each month makes saving easier. You don’t have to worry about remembering to save and can rest assured that the money is being transferred on schedule.

- Helps you reach your savings goals – By setting up regular transfers, you can set a goal for yourself and track your progress along the way. This makes it easier to stay on track when it comes to reaching your financial goals.

- Encourages discipline – Automatically transferring money each month helps build healthy saving habits. This can help you stay on track with your finances and encourage you to save more.

Drawbacks of Automatic Savings Plans

There are also some drawbacks to setting up an automatic savings plan. These include:

- Difficulty adjusting – Once you set up an automatic savings plan, it can be difficult to adjust. If you need to change the amount of money transferred each month or stop the transfers altogether, it can be time consuming and difficult.

- Missed opportunities – If you are saving a set amount each month, you may be missing out on potential opportunities to save more. For example, if you receive an unexpected bonus or windfall, you may not be able to take advantage of it if you are locked into an automatic savings plan.

How to Set Up an Automatic Savings Plan

Setting up an automatic savings plan is simple and easy. Most banks offer the ability to set up a recurring transfer online or through their mobile app. Before setting up, make sure you have a good understanding of your finances. Decide how much money you want to transfer each month and when the transfers should take place. Once you have a plan in place, talk to your bank about setting up an automatic savings plan.

FAQs

How can I make my savings automatic?

Setting up an automatic savings plan is easy. Most banks offer the ability to set up a recurring transfer from your checking account to your savings account online or through their mobile app. Decide how much money you want to transfer each month and when the transfers should take place, then talk to your bank about setting up the plan.

Can I adjust my automatic savings plan?

Yes, you can usually adjust your automatic savings plan. However, it can be time consuming and difficult. Before setting up an automatic savings plan, make sure you have a good understanding of your finances and know how much money you want to transfer each month and when the transfers should take place.

Is an automatic savings plan worth it?

Yes, an automatic savings plan can be worth it. It makes saving easier and helps you stay on track with your financial goals. It also encourages discipline and helps you build healthy saving habits. However, make sure to do your research and understand the potential drawbacks before setting up an automatic savings plan.

What is the advantage of an automatic savings contribution?

The main advantage of an automatic savings contribution is convenience. Automatically transferring money each month makes saving simpler and easier. You don’t have to worry about remembering to save and can rest assured that the money is being transferred on schedule. Additionally, it helps you stay on track with your financial goals and encourages discipline.

What is the disadvantage of an automatic savings contribution?

The main disadvantage of an automatic savings contribution is that it can be difficult to adjust once it’s been set up. If you need to change the amount of money transferred or stop the transfers altogether, it can be time consuming and difficult. Additionally, it can prevent you from taking advantage of potential opportunities to save more, such as unexpected bonuses or windfalls.

Can I cancel an automatic savings contribution?

Yes, you can usually cancel an automatic savings contribution. However, it can be time consuming and difficult. Before setting up an automatic savings plan, make sure you have a good understanding of your finances and know how much money you want to transfer each month and when the transfers should take place. Additionally, talk to your bank about their policies for canceling automatic savings plans.

What happens if I don’t have enough money in my account when an automatic savings contribution is scheduled?

If you don’t have enough money in your account when an automatic savings contribution is scheduled, the transfer may not be completed. It’s important to make sure you have enough money in your account to cover the transfer before it happens. Additionally, some banks offer the option to set up overdraft protection, which allows transfers to be made even if there isn’t enough money in your account.

Can I set up an automatic savings plan with multiple accounts?

Yes, you can usually set up an automatic savings plan with multiple accounts. For example, you could set up an automatic transfer from your checking account to multiple savings accounts each month. Talk to your bank about their policies for setting up an automatic savings plan with multiple accounts.

Do I need to set up an automatic savings plan?

No, you don’t necessarily need to set up an automatic savings plan. It can be a helpful tool for reaching your financial goals, but it’s not required. You can still save money in other ways, such as setting aside a portion of each paycheck or transferring money from your checking account to your savings account manually. Whichever method you choose, make sure to do your research and understand the potential drawbacks before setting up an automatic savings plan.

Is it smart to put all your money in savings?

No, it’s not smart to put all your money in savings. While saving is important, it’s also important to have an emergency fund set aside and to invest your money. Therefore, it’s best to keep a balance between your savings account, emergency fund, and investments. Decide how much money you want to save each month and invest the rest in a diversified portfolio.

Can I pause an automatic savings plan?

Yes, you can usually pause an automatic savings plan. However, it can be difficult and time consuming to do so. Before setting up an automatic savings plan, make sure you understand all the potential drawbacks and have a good understanding of your finances. If you need to pause the plan, talk to your bank about the best way to do so.

Are there any fees associated with automatic savings plans?

Yes, there may be fees associated with automatic savings plans. These fees vary from bank to bank, so make sure to do your research and ask about all the fees before setting up an automatic savings plan. Additionally, some banks may offer cash bonuses or other incentives for setting up an automatic savings plan. Ask your bank about any promotions they offer to get the most out of your savings.

Conclusion

An automatic savings plan is a great way to save money without having to think about it. It can help you reach your savings goals, encourage disciplined saving habits and make it easier to stay on track with your finances. Setting up an automatic savings plan is simple and can be done quickly through your bank’s website or mobile app.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

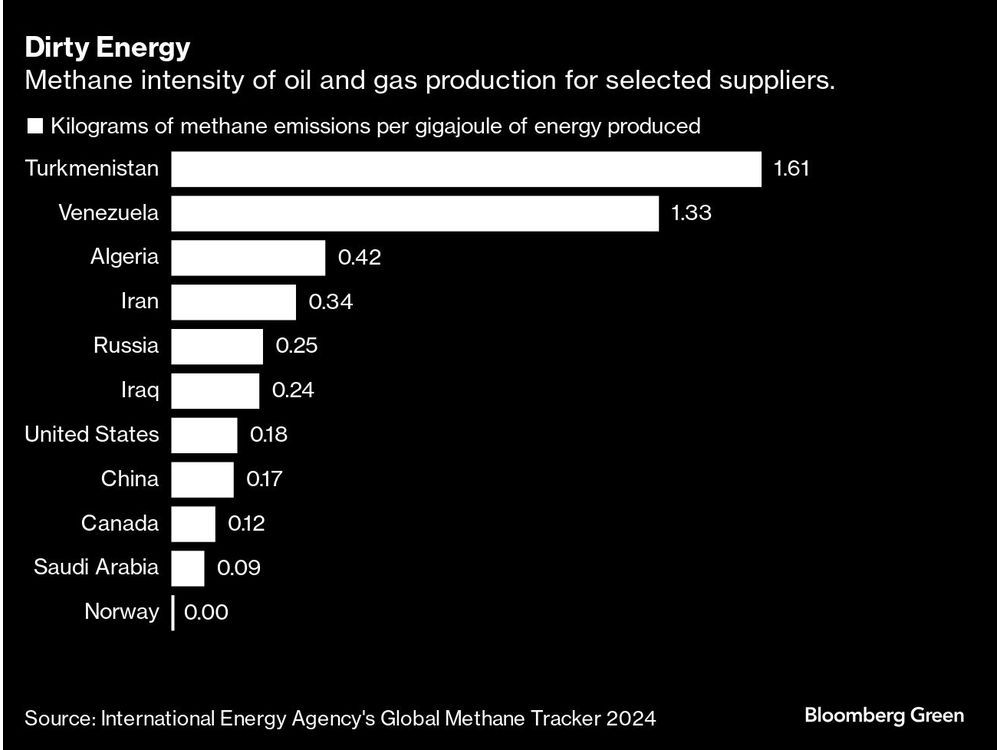

Satellite observations show the amount of gas burned at Turkmenistan’s Gates of Hell crater have fallen roughly 50% since August, according to a new analysis.