Follow us on LinkedIn

If you’re looking for a way to build your business credit, you may be considering using business credit cards. But does using business credit cards actually help to build business credit? And are there any other ways to go about it? In this blog post, we’ll explore how business credit cards can help to build your business credit score, as well as some other methods you can use.

The answer is yes. When you use a business credit card, the account is reported to business credit reporting agencies. This helps to establish a history of your company’s credit use, which in turn can help to boost your business credit score. Additionally, paying your business credit card bills on time and keeping a low balance can also help to improve your score.

If you’re not sure whether or not business credit cards are right for you, there are a few other options to consider. You can try using a personal credit card for business expenses, taking out a small business loan, or applying for business lines of credit. Whichever method you choose, make sure to keep an eye on your credit utilization and always pay your bills on time to help improve your business credit score.

Business credit cards can be a great way to build your business credit score, but they’re not the only method out there. If you’re looking for other ways to improve your business credit, consider some of the other options we’ve mentioned.

Do business credit cards affect personal credit?

No, your business credit card does not affect your personal credit. Your business credit score is based on your company’s credit history, not your personal credit history. Therefore, using a business credit card will not impact your personal credit score in any way. Additionally, if you decide to close your business credit card account, it will also not affect your personal credit score.

Can I use my business credit card for personal expenses?

Yes, you can use your business credit card for personal expenses. However, it’s important to remember that your business credit card is a business expense and should be used as such. If you use your business credit card for personal expenses, you may be putting your business at risk of not being able to pay back the debt. Additionally, if you don’t pay your business credit card bills on time, it could negatively impact your business credit score. Therefore, it’s important to use your business credit card wisely and only for business expenses.

Are business credit card fees tax deductible?

Yes, business credit card fees are tax-deductible. You can deduct the annual fee as well as any other fees associated with your account, such as late fees, over-the-limit fees, and cash advance fees. However, you cannot deduct interest charges.

Do business credit cards appear on a personal credit report?

No, your business credit card will not appear on your personal credit report. Your business credit score is based on your company’s credit history, not your personal credit history. Therefore, using a business credit card will not impact your personal credit score in any way. Additionally, if you decide to close your business credit card account, it will also not affect your personal credit score.

When you use a business credit card, the account is reported to business credit reporting agencies. This helps to establish a history of your company’s credit use, which in turn can help to boost your business credit score. Additionally, paying your business credit card bills on time and keeping a low balance can also help to improve your score.

If you’re not sure whether or not business credit cards are right for you, there are a few other options to consider. You can try using a personal credit card for business expenses, taking out a small business loan, or applying for business lines of credit. Whichever method you choose, make sure to keep an eye on your credit utilization and always pay your bills on time to help improve your business credit score.

Bottom line

Business credit cards can be a great way to build your business credit score. However, they’re not the only method out there. If you’re looking for other ways to improve your business credit, consider some of the other options we’ve mentioned.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

TORONTO, April 29, 2024 (GLOBE NEWSWIRE) — Golconda Gold Ltd. (“Golconda Gold” or the “Company”) (TSX-V: GG; OTCQB: GGGOF) is pleased to announce the release of its financial results for the year ended December 31, 2023. All amounts are in United States dollars unless otherwise…

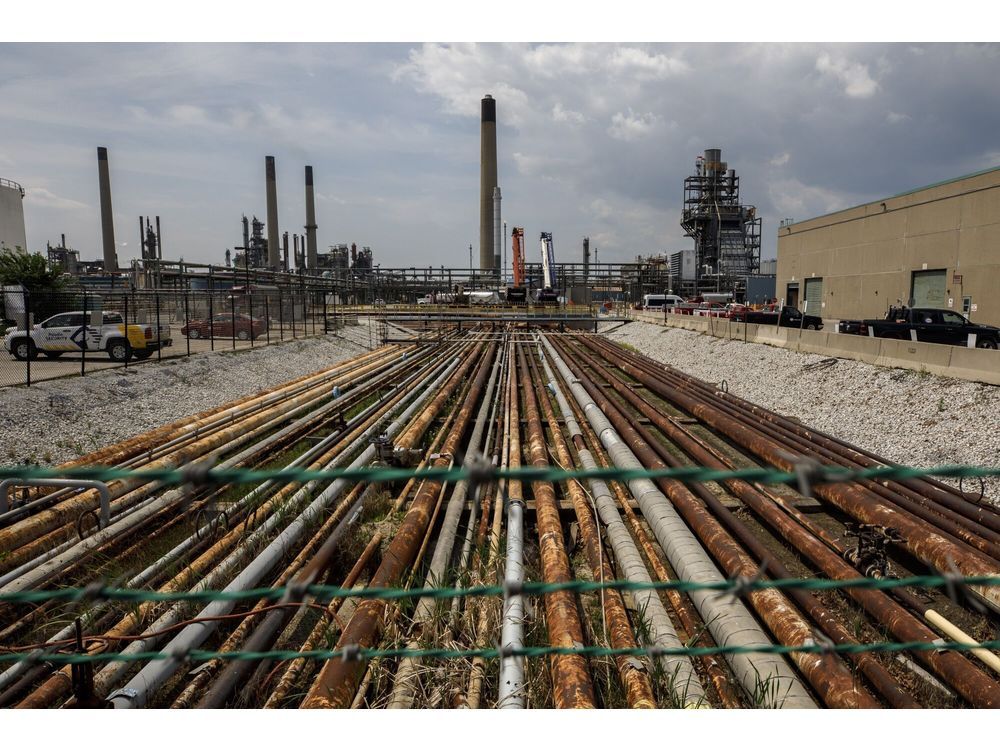

An indigenous community in Alberta’s oil-sands region submitted a proposal to Imperial Oil Ltd. shareholders that would require the company to disclose the financial effect of the energy transition.