Follow us on LinkedIn

In the world of investing and trading, success often hinges on making sound decisions based on accurate assessments of one’s abilities and the market’s dynamics. However, the human mind is susceptible to biases that can cloud judgment and lead to suboptimal outcomes. One such cognitive bias is the Dunning-Kruger effect, a psychological phenomenon that has profound implications for investors and traders alike.

What is the Dunning-Kruger Effect?

The Dunning-Kruger effect refers to the tendency of individuals with limited knowledge or skills in a particular domain to overestimate their competence. Conversely, those who are highly skilled or knowledgeable in the same domain may underestimate their abilities. This phenomenon arises from a lack of metacognitive awareness—the ability to accurately assess one’s own competence—and can result in overconfidence, poor decision-making, and an inflated sense of expertise.

Analyzing the Dunning-Kruger effect

Measuring and analyzing the Dunning-Kruger effect requires a multifaceted approach that combines psychological assessments, cognitive tests, and behavioral observations. One common method involves administering self-assessment questionnaires to individuals to gauge their perceived competence in a specific domain relative to their actual performance. These questionnaires typically ask participants to rate their skills, knowledge, or abilities in various areas and compare their self-perceptions to objective measures of performance, such as test scores or task completion rates. Discrepancies between self-assessments and objective measures can indicate the presence of the Dunning-Kruger effect.

Furthermore, researchers may use cognitive tasks or problem-solving exercises to assess individuals’ actual competence in a given domain. By comparing participants’ performance on these tasks to their self-assessed levels of competence, researchers can identify instances of overestimation or underestimation consistent with the Dunning-Kruger effect. Additionally, longitudinal studies that track individuals’ progress and development over time can provide valuable insights into how the Dunning-Kruger effect manifests and evolves across different stages of skill acquisition. Through careful analysis of these data, researchers can gain a deeper understanding of the mechanisms underlying the Dunning-Kruger effect and develop strategies to mitigate its impact on decision-making and performance.

Examples of the Dunning-Kruger Effect

An example of the Dunning-Kruger effect in investing and trading is when novice traders enter the market with unrealistic expectations and overestimate their ability to predict market movements. They may engage in high-risk strategies without fully understanding the potential downsides, leading to significant losses. Conversely, seasoned investors who have experienced success may underestimate the complexity of the market and fail to adapt to changing conditions, resulting in missed opportunities or unexpected setbacks.

Implications in Investing and Trading

The Dunning-Kruger effect can have profound implications for investors and traders. Overconfidence stemming from the belief that one possesses greater knowledge or skill than is actually the case can lead to excessive risk-taking, failure to conduct proper due diligence, and susceptibility to behavioral biases such as confirmation bias and anchoring. Conversely, underestimating one’s abilities may result in missed opportunities for growth and a reluctance to take calculated risks that could lead to higher returns.

Conclusion

Recognizing and mitigating the impact of the Dunning-Kruger effect is essential for investors and traders seeking to navigate the complexities of the financial markets successfully. By cultivating self-awareness, remaining humble, and continually seeking to improve their knowledge and skills, individuals can avoid the pitfalls of overconfidence and make more informed decisions that align with their investment goals and risk tolerance.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

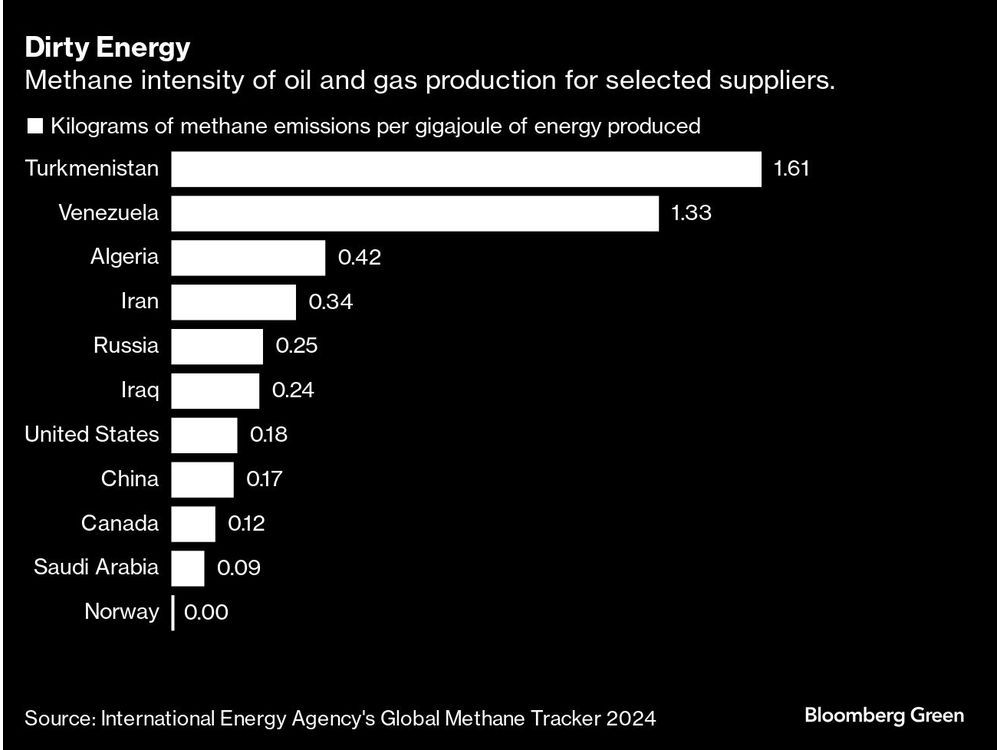

Satellite observations show the amount of gas burned at Turkmenistan’s Gates of Hell crater have fallen roughly 50% since August, according to a new analysis.