Follow us on LinkedIn

Navigating the world of insurance can often seem like a daunting task. Different policies, premium payments, and various clauses make it a complex field. One such term that frequently comes up in insurance discussions is the ‘Nonforfeiture Clause’.

It holds significant importance in life insurance and long-term care policies. This term might sound complicated, but it is crucial for policyholders to understand its implications.

It plays a key role in ensuring policyholders’ rights and safeguards their investments in certain scenarios. Understanding the concept of the Nonforfeiture Clause can help you make informed decisions when purchasing or reviewing insurance policies.

What is a Nonforfeiture Clause?

A Nonforfeiture Clause is an essential component of standard life insurance and long-term care policies. It outlines that if a policy lapses due to missed premium payments after a certain period, the policyholder is entitled to a partial or full refund of the premiums paid.

Furthermore, in the case of whole life insurance policies, this clause can be invoked when the policyholder decides to surrender the policy.

Essentially, the Nonforfeiture Clause serves as a protective measure, ensuring that policyholders’ investments are not entirely lost in certain situations. It underlines the commitment of insurance providers to uphold the rights of their clients.

How Nonforfeiture Clause Works

The Nonforfeiture Clause is activated when a policyholder stops paying premiums after a certain period, causing the policy to lapse.

The clause stipulates that the insurance company must give back a portion of the premiums paid. The returned amount may be in cash or as reduced paid-up insurance or extended-term insurance, depending on the policy terms.

In case of policy surrender, the clause enables the policyholder to receive the policy’s cash value.

Essentially, the Nonforfeiture Clause ensures that even if the policyholder discontinues the policy or cannot continue paying premiums, they do not lose all their money.

It keeps the insurance company from retaining the entire premium amount, providing a safety net for the policyholder.

Payout Options of Nonforfeiture Clause

Here are some of the main payout options available under the Nonforfeiture Clause

- Cash Surrender Value

When a policyholder opts for the cash surrender value, the insurer pays the remaining cash value within six months. This option reflects the policy’s savings component. Permanent life insurance typically generates low returns initially, with profits starting around the third year.

The longer a policy is the greater the cash and nonforfeiture values are. However, the cash surrender value may differ from the due cash value and will be reduced by any outstanding loan amount.

- Extended Term Option

The extended-term payout option lets policy owners purchase a new policy using the original policy’s cash values. The duration of this new policy depends on the original policy’s available cash values and the insured’s age when choosing the extended-term option.

Some insurers automatically offer this option if the original policy lapses from missed premiums. It allows policy owners to stop paying premiums while keeping earned equity.

- Reduced Paid-Up Insurance

The reduced paid-up insurance option offers policy owners a lower death benefit without additional premium payments.

This amount, however, is less than the original policy’s cash value. The reduced coverage gets calculated based on the insured’s age, cash surrender value, and paid premiums. Insurers typically require a minimum of three years of paid premiums for eligibility.

Conclusion

One of the key identifying features of insurance policies is the Nonforfeiture Clause. It plays an important role in safeguarding policyholders’ investments and allowing them to receive a portion or the full amount of their money back if they discontinue their policies. Understanding it can help you make an informed decision when purchasing insurance policies and ensure that your investments are safe.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

TORONTO, April 29, 2024 (GLOBE NEWSWIRE) — Golconda Gold Ltd. (“Golconda Gold” or the “Company”) (TSX-V: GG; OTCQB: GGGOF) is pleased to announce the release of its financial results for the year ended December 31, 2023. All amounts are in United States dollars unless otherwise…

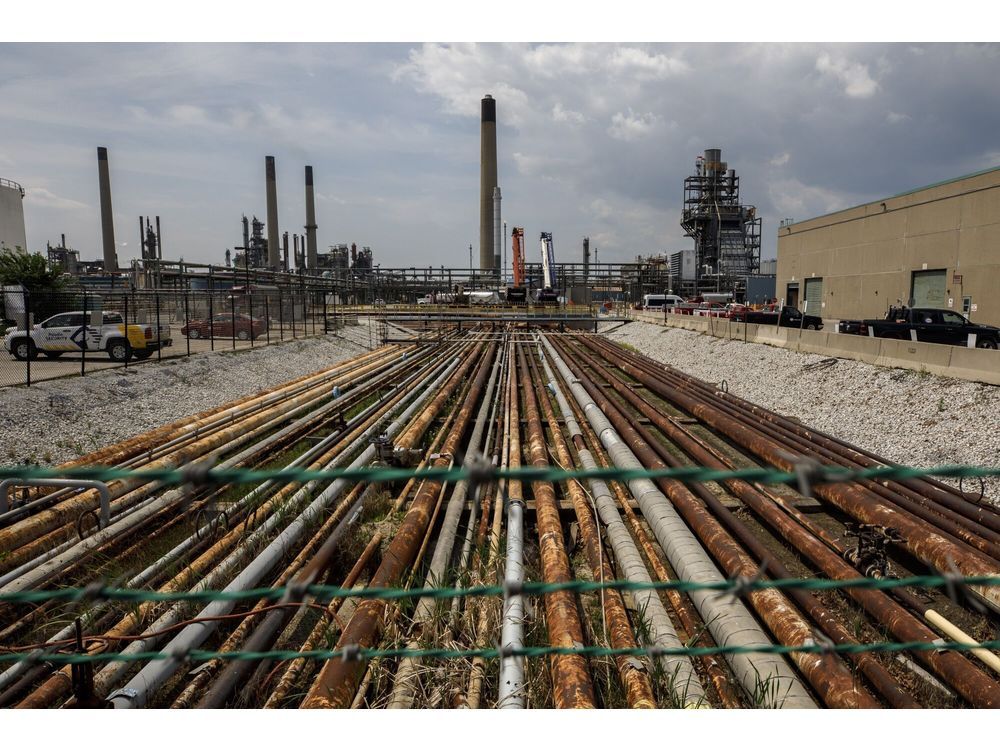

An indigenous community in Alberta’s oil-sands region submitted a proposal to Imperial Oil Ltd. shareholders that would require the company to disclose the financial effect of the energy transition.