The balance sheet is crucial as it provides a comprehensive overview of a company’s financial position. It is the primary tool for assessing the company’s stability, financial health, and overall worth. By analyzing the balance sheet, stakeholders gain insights into the company’s assets, liabilities, and shareholders’ equity, enabling them to make informed decisions about investments, creditworthiness, and strategic planning.

While companies mostly prepare the balance sheet to reflect their historical position, they may also require it for future projections. This statement falls under the definition of a pro forma balance sheet.

What is a Pro Forma Balance Sheet?

A pro forma balance sheet is a financial statement that presents a hypothetical or projected snapshot of a company’s financial position. Typically, companies prepare it to illustrate the potential impact of specific events, transactions, or changes in business circumstances on its financials. The pro forma balance sheet allows stakeholders to evaluate the potential risks and benefits of the proposed changes and make more informed decisions.

The pro forma balance sheet includes adjustments and assumptions to reflect the anticipated effects of the proposed changes. These changes can include acquisitions, mergers, new investments, changes in capital structure, or significant changes in revenue or expenses. However, the pro forma balance sheet only projects future results and may not reflect actual results.

What’s the difference between a Pro Forma and a Regular Balance Sheet?

A regular balance sheet, or a historical balance sheet, provides a snapshot of a company’s financial position at a specific point in time based on actual data and transactions. It presents the company’s assets, liabilities, and shareholders’ equity as recorded in the accounting books, reflecting the historical and current financial status.

On the other hand, a pro forma balance sheet is a projected financial statement that outlines the expected financial position of a company based on assumptions and estimates. It is forward-looking and accounts for potential changes or events that have not yet occurred. Pro forma balance sheets are often used to forecast the financial impact of future events, such as new investments, business expansion, or changes in capital structure.

What is the format of the Pro Forma Balance Sheet?

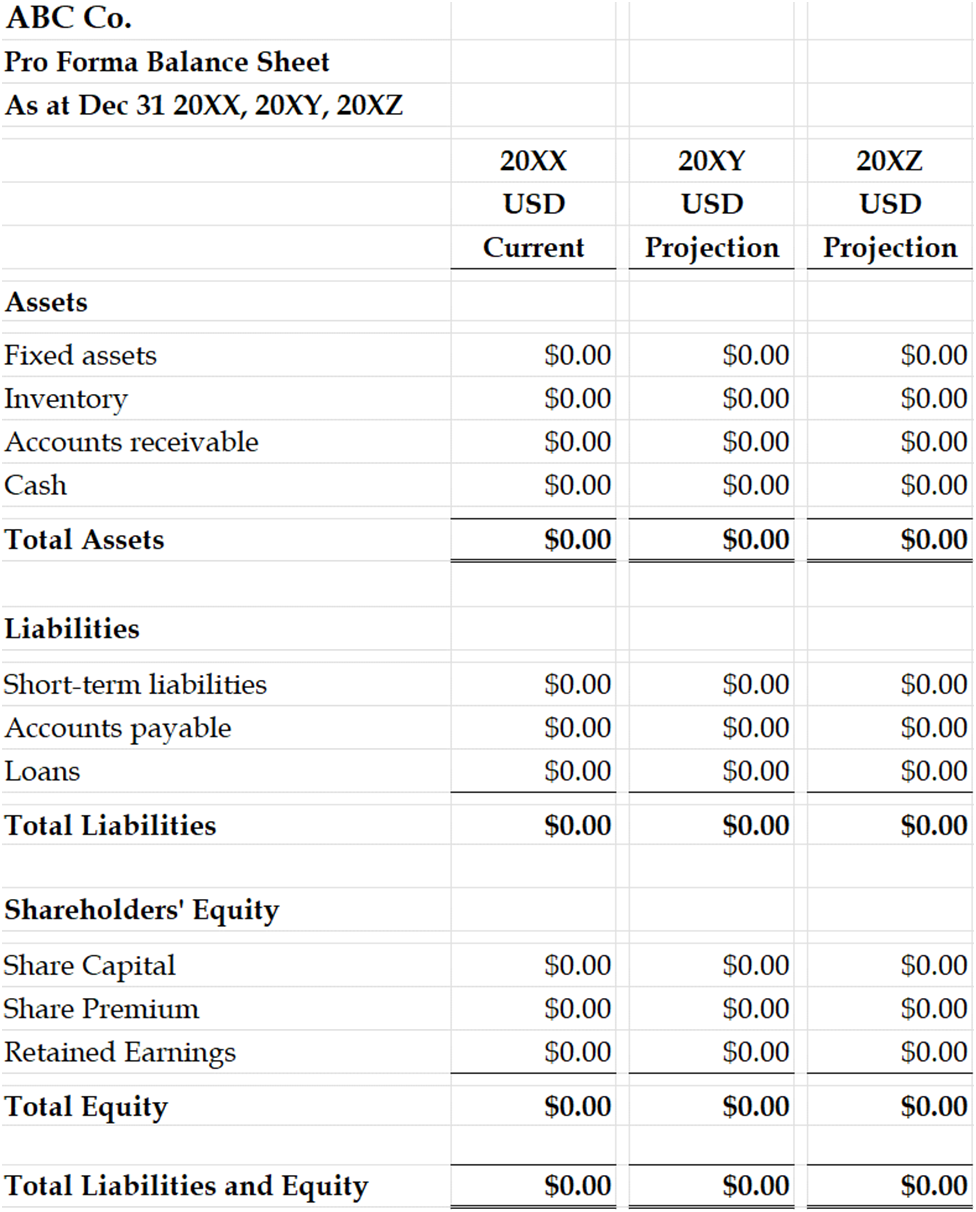

The format of a pro forma balance sheet is similar to that of a regular balance sheet. It includes three main sections: assets, liabilities, and shareholders’ equity. As mentioned, it projects the future rather than reflects historical figures. An example of a format for the pro forma balance sheet is below.

Pro forma balance sheet example, template in Excel

The above example shows that the current year for the company ABC Co. is 20XX. The company used 20XX as a base to project 20XY and 20XZ. Practically, companies link these results from the pro forma income statement. On top of that, companies use percentages to increase the balances for each account. Companies may also expand this format for pro forma balance sheets to include current and non-current sections for assets and liabilities.

Conclusion

The balance sheet is a financial statement that reflects a company’s financial position. It uses historical figures to represent each accounting balance. Sometimes, companies may also prepare a pro forma balance sheet. This format uses percentages and other factors to project the company’s future financial position. The pro forma balance sheet is not an accounting statement but rather used for decision-making purposes.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

"It Ends with Us" star Blake Lively filed a legal complaint against her costar, Justin Baldoni, for sexual harassment and for conspiring to damage her reputation.

She taught them how stocks and savings bonds work and encouraged them to be self-reliant, skills that have help them reach their own milestones.