An income statement is a financial statement that shows a company’s revenues, expenses, gains, and losses over a specific period. It reflects the company’s ability to generate profits by comparing revenues with expenses. Similarly, it helps evaluate profitability, cost management, and overall financial performance by revealing the net profit or loss from core business activities and other related income and expenses.

The income statement reflects a company’s financial performance for the last financial period. Companies may also prepare a pro forma income statement to predict future revenues and expenses. However, its format may differ from one company to another based on their needs.

What is a Pro Forma Income Statement?

A pro forma income statement is a financial statement that provides a projected or estimated view of a company’s expected revenues, expenses, gains, and losses for a future period. It is prepared based on assumptions and hypothetical scenarios to forecast financial performance. The pro forma income statement typically includes projected revenues from sales, services, or other sources.

Pro forma income statements are crucial for businesses when planning for future operations, making strategic decisions, or seeking financing. They allow stakeholders to evaluate the potential financial impact of various scenarios, assess profitability, and gauge the feasibility of business plans or investments. It serves as a tool for analysis and decision-making, providing a projected financial picture for planning and evaluation purposes.

What’s the difference between Pro Forma and a Regular Income Statement?

A regular income statement, also known as a historical income statement, presents the revenues, expenses, gains, and losses incurred by a company during a specific period. It provides a retrospective view of the company’s financial performance and reflects the results based on past transactions and events. The regular income statement provides a historical record.

On the other hand, a pro forma income statement is a projected or forecasted financial statement that outlines the expected revenues, expenses, gains, and losses for a future period. It illustrates the potential financial outcomes of specific events, changes in business operations, or strategic decisions. While a regular income statement shows the actual financial performance, a pro forma income statement focuses on anticipated or hypothetical scenarios.

What is the format for Pro Forma Income Statement?

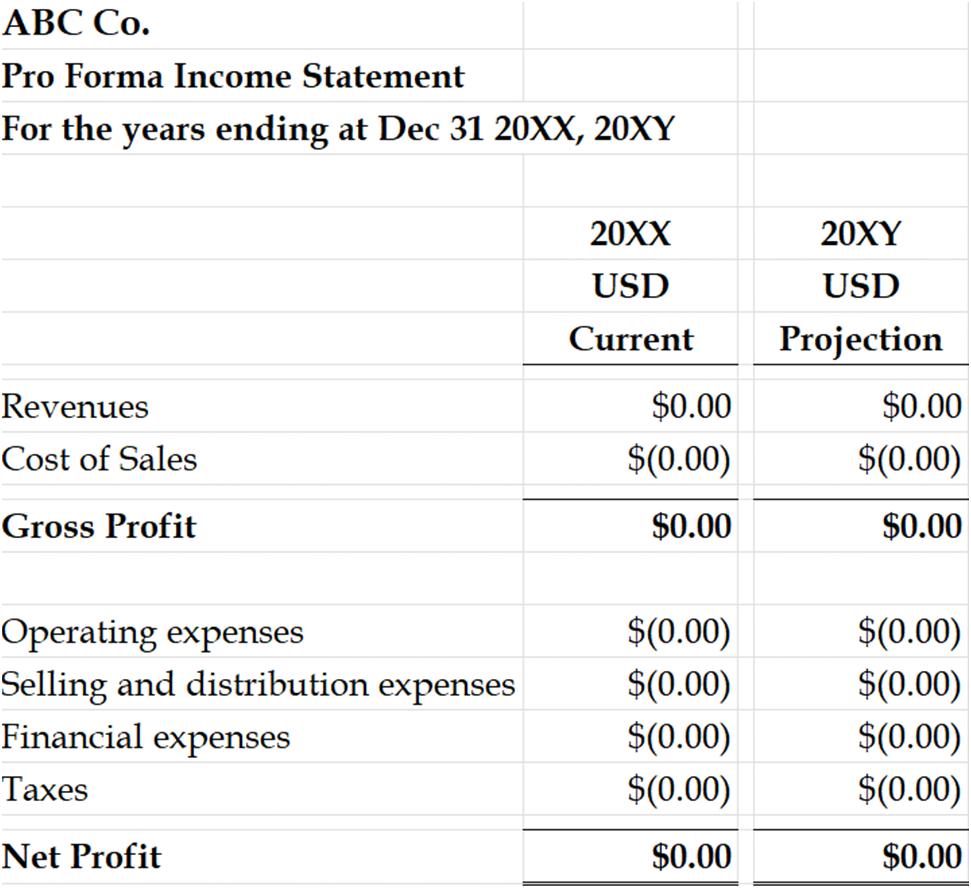

The pro forma income statement does not have a specific format. Companies can prepare this statement in any template. Primarily, it uses the same format as a regular income statement with projections for future performance. Nonetheless, below is an example of how the pro forma income statement may look.

Pro forma income statement template in Excel

The above pro forma income statement includes the current year (20XX) for the company ABC Co. Based on that, it also projects for 20XY. Usually, companies use the current year as a base to project the financial performance for the future. Companies can expand this format by including more years or line items as required.

Conclusion

The pro forma income statement projects a company’s financial performance for the future. It uses estimates and predictions based on expected events or circumstances. Usually, companies use it to budget for the future or forecast their performance for future periods. It differs from the regular income statement as the pro forma focuses on the future, while the former includes historical figures.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum