The income statement is a financial document that presents a company’s financial performance over a specific period. Companies use a structure provided by the accounting standards to prepare income statements for external reporting. However, they may also use the same format for internal reporting.

The variable costing income statement is a valuable report in cost accounting. As the name suggests, it focuses on a specific type of cost. However, there is more to the statement than implied by the name.

What is the Variable Costing Income Statement?

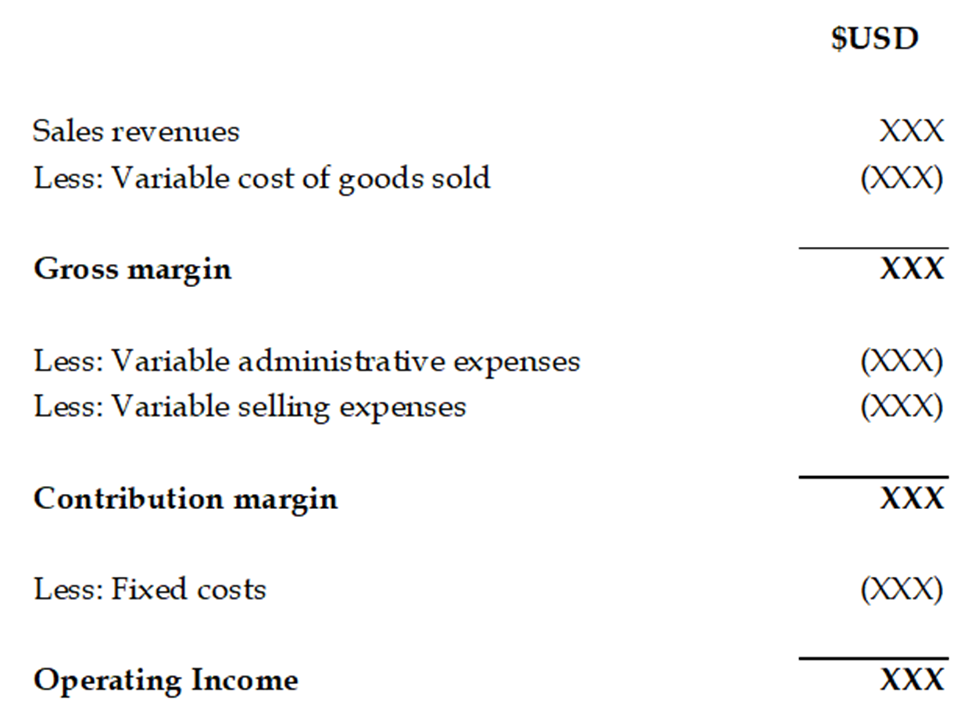

A variable costing income statement is a financial statement that focuses on the variable costs associated with a company’s operations. It separates variable costs from fixed costs, treating fixed costs as period expenses rather than allocating them to products. The statement typically includes sales revenue, variable costs of goods sold, gross margin, variable selling and administrative expenses, contribution margin, fixed costs, and operating income.

The variable costing income statement provides an understanding of the costs and profitability of products or services by emphasizing the costs directly related to production. Although the format differs from a standard income statement, it follows the same principle. However, the variable costing income statement is only a part of internal or managerial accounting. Companies do not present it for external reporting.

Why is the Variable Costing Income Statement important?

Companies use the variable costing income statement for several reasons. One key reason is that it helps management understand the impact of changes in production volume on costs and profitability. Unlike the traditional absorption costing method, variable costing treats fixed manufacturing costs as period expenses. It means that only variable production costs, such as direct materials, direct labour, and variable overhead, are included in the cost of goods sold.

By separating fixed and variable costs, the variable costing income statement provides a clearer picture of how changes in production levels affect costs and profits. This information is valuable for decision-making, as it allows managers to assess the cost and profitability implications of changes in sales volume, pricing strategies, or production levels. Similarly, it provides insights into the contribution margin, which helps analyze profitability.

What is the format for the Variable Costing Income Statement?

The format for variable costing income statements may differ based on a company’s needs and policies. However, it generally uses a similar format to the one provided below.

Example of Variable Costing Income Statement

What is the difference between Variable Costing and Traditional Income Statement?

The variable costing income statement differs from the traditional income statement in fixed manufacturing overhead costs. In the former approach, fixed manufacturing overhead costs are not allocated to products. Instead, they are treated as period expenses and are deducted entirely from the revenue in the period incurred.

In contrast, the traditional income statement follows the absorption costing method, where fixed manufacturing overhead costs are allocated to products as part of the cost of goods sold. It means that a portion of fixed costs is assigned to each unit produced, regardless of whether it is sold or remains in inventory. Therefore, the variable costing income statement provides a clear view of the relationship between production volume and costs.

Conclusion

The income statement is a crucial report focusing on a company’s financial performance. Companies can use the same principle to prepare a variable costing income statement for internal reporting. The latter focuses on variable costs by treating fixed costs as period expenses. Similarly, the format of this income statement may differ from the traditional one.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum