More and more investors are using the power of computing technologies and quantitative techniques to manage their portfolios these days. They believe that quantitative trading can help reduce the PnL volatility resulted from emotional decision making and thus increase the consistency of returns. However, sometimes the machine beats the man, and sometimes it does not. Recently, quantitative funds seemed to suffer considerable losses after British Prime Minister Theresa May shocked markets by calling a snap election.

Among the most high-profile losers was Connecticut-based investment firm AQR Capital Management’s $13.3 billion computer-driven Managed Futures Strategy, which lost 1.1 percent on Tuesday, according to an investor who was told by the hedge fund, representing a loss of more than $130 million. The same strategy made 5.2 percent on the day the results of Britain’s EU referendum were revealed in June.

Two other hedge funds run by machines, which the investor declined to name, lost 2.8 percent and 1.9 percent. Read more

As pointed out by Maiya Keidan et al, the strategies that lost money were mostly trend-following in nature.

Trend following is a very popular strategy. Another, lesser-known type of quantitative trading, which we write extensively about in our blog, takes place in the volatility space. Specifically, volatility traders and hedgers bet on the future volatility dynamics or distribution of returns. They can do so by using mathematical models to predict the implied and/or realized volatilities. One of the most popular volatility prediction methods is the GARCH model. However, there exist other lesser-known quantitative methods, such as factor models that can be used to predict the volatility and help with decision making. As reported by Andrea Wong, such a factor model is being used by a hedge fund.

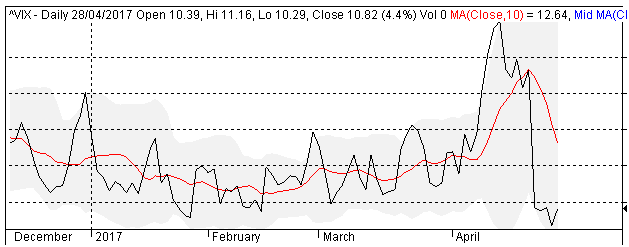

VIX as of Apr 28, 2017. Source: Yahoo finance

There are a number of reasons to heed the signals from Noorani and his team: their model, which analyzes around 30 macroeconomic factors from rate differentials to China’s credit default swaps, explains 91 percent of the movement in dollar-yen over a rolling four-month period. It sent out warning signals in mid-February before the dollar peaked. The framework was developed by Michael Hobson, a professor of astrophysics at the University of Cambridge. Read more

While quantitative trading is believed to be beneficial to many market participants, some observers and regulators are worried about its negative impact on the market, especially during a downturn. Recently Keith Savard wrote:

The risk of turmoil is even greater given that markets already are trying to absorb a technological revolution that includes enhanced algorithmic trading, the proliferation of electronic bond trading platforms and increased reliance on exchange-traded funds (ETFs).Read more

So is the jury still out whether we should embrace quantitative trading or not?

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

A proposal to give up search and user data faces long odds but still raises the stakes for the company.

After US federal prosecutors charged Gautam Adani and several associates with fraud, media coverage in India has ranged from dryly factual to over-the-top in its defensiveness, revealing a divide over how to appraise bribery accusations against one of the nation’s richest businessmen.

As artificial wave pools proliferate around the world, surf park developers aim to go green to counter criticism over energy and water use.