With the popularity of Exchange Traded Funds on the rise and an exponential increase in short interests in the volatility ETFs, it’s just a question of time that ETF issuers will launch new instruments aiming at the volatility markets in other geographical locations. Indeed, last month, VelocityShares issued 2 new volatility ETFs that allow investors to gain exposure to volatility in the European markets, i.e. the VSTOXX index.

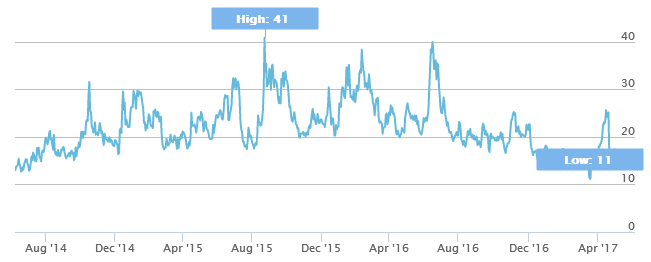

VSTOXX Volatility Index as at June 7, 2017. Source: stoxx.com

… Janus rolled out the VelocityShares 1X Long VSTOXX Futures ETN (BATS: EVIX), which is linked to the VSTOXX Short-Term Futures Investable Index USD, and the VelocityShares 1X Daily Inverse VSTOXX Futures ETN (BATS: EXIV), which is linked to the VSTOXX Short-Term Futures Inverse Investable Index USD. Both EVIX and EXIV come with a 1.35% expense ratio.

EVIX and EVIX reflect indices based on VSTOXX Short-term Futures, a widely observed measure of European equity market volatility, similar to what the VIX or CBOE Volatility Index does based on U.S. equity market volatility.

Specifically, the VSTOXX Short-Term Futures Investable Index tries to reflect the performance of a long position in a portfolio of VSTOXX futures to provide exposure to constant-maturity one-month forward, one-month implied volatilities on the underlying EURO STOXX 50 Index. Due to its long exposure to VSTOXX futures, the EVIX will likely increase in value when the volatility of European equities rises and more likely decrase in value when volatility of European equities diminishes.

Meanwhile, the VSTOXX Short-Term Futures Inverse Investable Index tries to reflect the performance of a short or inverse position in a portfolio of VSTOXX futures designed to provide exposure to constant-maturity one-month forward, one-month implied volatilities on the same underlying index. Due to its short exposure to VSTOXX futures, EXIV is likely to rise in value when volatility of European equities dissipates and likely to dip in value when volatility in European equities increases. Read more

So the US investors now can have easy access to European volatility market. And it would be interesting to see how the new ETF issuance will affect the volatility futures and spot prices in Europe.

In the mean time, we performed a quick study by calculating the same statistics that we presented in the post entitled Is Volatility of Volatility Increasing. The table below gives the dates and changes in the volatility index when the daily STOXX returns were between -2.5% and -1.5%, and the VSTOXX index experienced an increase of 18% or greater. The data is from 2003 to the present.

| Date | Vol change |

| 22-Sep-03 | 20.41% |

| 17-Nov-03 | 18.92% |

| 22-Mar-04 | 22.09% |

| 15-Apr-05 | 25.72% |

| 30-May-06 | 18.16% |

| 08-Oct-08 | 19.65% |

| 07-May-10 | 34.72% |

| 17-Jul-14 | 19.15% |

| 17-Apr-15 | 24.60% |

| 21-Aug-15 | 18.49% |

| 17-May-17 | 19.23% |

It’s interesting to note that the volatility spikes in European spot volatility index happened less frequently and less violently as compared to the US counterpart.

Last and not least, Sumit Roy presented some interesting observations when comparing the European volatility index and futures to their US counterparts:

- VSTOXX Systematically Higher Than VIX: A lot of that has to do with the fact that the underlying stock index for VSTOXX has only 50 components compared with 500 for the VIX

- The contango is lower the difference between front-month futures and subsequent contracts―is generally lower for VSTOXX compared with VIX. Read more

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum