Follow us on LinkedIn

Household debts are common in today’s society. While some debt is necessary, such as for a mortgage or education, too much debt can be crippling.

While there are many reasons for this high level of indebtedness, one of the main culprits is the increasing cost of living.

In addition, wages have remained stagnant while housing prices and other costs have continued to rise. As a result, more and more people are finding themselves struggling to keep up with their monthly payments.

What is household debt

Household debts are defined as money owed by individuals to financial institutions. This debt can be in the form of credit cards, loans, mortgages, or lines of credit.

Many people carry some form of debt, and it’s important to understand how these debts work before taking on any new obligations.

There are two main types of debt: unsecured and secured. Unsecured debt is not backed by any collateral, which means that the lender has no claim on your assets if you default on the loan. One of the most common types of unsecured debts is credit card debt.

Secured debt is backed by collateral, which gives the lender a claim on your assets if you default on the loan. Mortgage loans would be a good example of secured loans.

Debt can also be classified as revolving or non-revolving. Revolving debt has no set repayment schedule, which means you can borrow and repay the debt as you please.

Non-revolving debt has a set repayment schedule, which means you must repay the debt in full by a certain date. One of the most popular non-revolving debts would be student loans.

Recent data on household debts

Only in the USA, the household debt rose to a new peak in the 2nd quarter of 2022 to $16.15 trillion.

Mortgage debt was the largest contributor to the increase, rising by $207 billion to $11.39 trillion.

Other types of debt also increased over the quarter, including auto loans, credit cards, and student loans.

Compared to the previous quarter, household debt increased by almost $1 trillion.

Statistics for American debt 2022

Here is a list of statistics regarding American debt in 2022:

- Mortgage debt: $11.39 trillion

- Line of credit (Home equity): $320 billion

- Student loan debt: $1.59 trillion

- Auto debt (Car loans): $1.50 trillion

- Credit card debt: $890 billion

- Other (Personal loans, medical debt, etc.): $470 billion

Total household debt: $16.15 trillion

Statistics for average American debt 2022

Here is a list of statistics regarding the average American debt in 2022

- Mortgage debt: $220,380

- Home equity line of credit (HELOC): $39,556

- Student loan debt: $39,487

- Auto loan debt and lease: $20,987

- Average credit card debt: $5,221

- Personal loans: $17,064

Average household debt: $96,300

Conclusion

Household debts are all-time high right now! From the high cost of living to the recent pandemic, reasons are many why people are struggling to keep up with their monthly payments. It’s important to understand how these debts work and take on new obligations only when necessary.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

TORONTO, April 29, 2024 (GLOBE NEWSWIRE) — Golconda Gold Ltd. (“Golconda Gold” or the “Company”) (TSX-V: GG; OTCQB: GGGOF) is pleased to announce the release of its financial results for the year ended December 31, 2023. All amounts are in United States dollars unless otherwise…

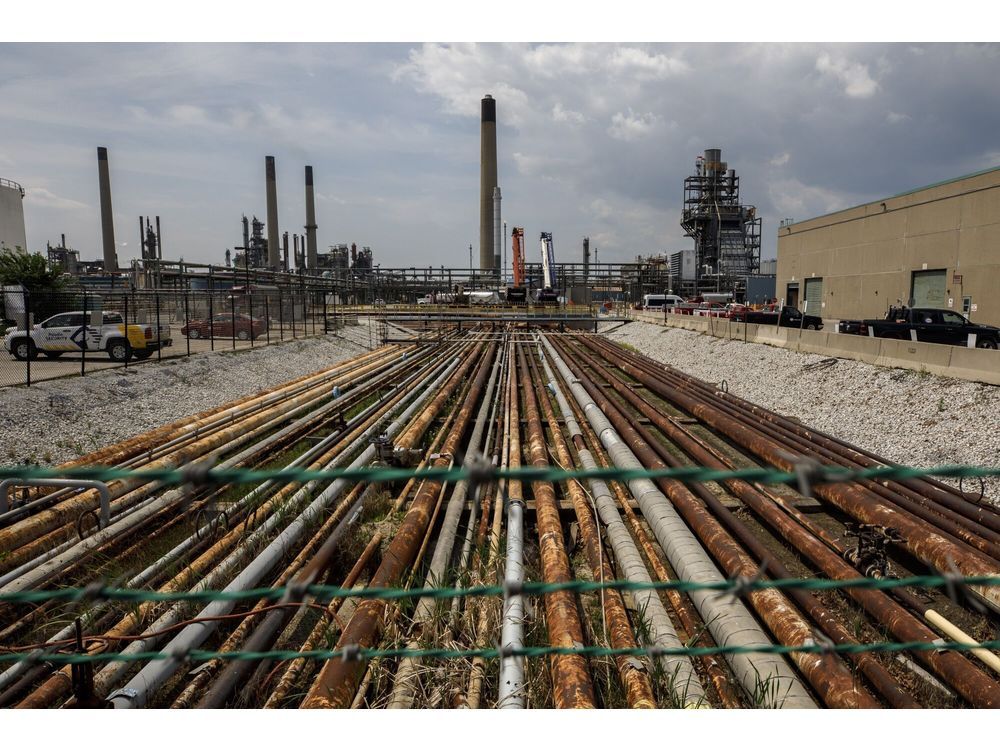

An indigenous community in Alberta’s oil-sands region submitted a proposal to Imperial Oil Ltd. shareholders that would require the company to disclose the financial effect of the energy transition.