Follow us on LinkedIn

Companies fund their capital structures through equity and debt. While the former comes from shareholders, the latter originates from lenders. Usually, companies use several forms of debt to fund their operations. However, these come with a default risk to the lender. Lenders can recover losses if their loans have collateral backing from the company.

However, if a company obtains debt from several sources, it complicates the recovery process. Each lender wants to receive priority over the funds recovered from the company. However, the seniority of these debts is crucial when establishing the order of repayments.

What is Seniority Ranking?

Seniority ranking refers to the priority standing of loans. It establishes the order for repaying lenders when a company defaults on its loans. However, this ranking becomes relevant when a company goes bankrupt or liquidates. In normal operations, the seniority ranking plays little role in how companies manage and repay debts. However, it does not imply that seniority ranking is not critical.

Seniority ranking helps companies distinguish between different classes of debt. Usually, secured debt receives a higher priority than unsecured debt due to the collateral involved. Even then, more subclasses may exist within the structure. For example, first-lien debt receives a higher priority than second-lien debt despite both having collateral backup. Generally, the terms senior and junior debt are relevant to seniority ranking.

What are Senior and Junior Debt?

The terms senior and junior debt refer to the different classes of debt based on their priority. Therefore, it is crucial to understand both.

Senior debt

Senior debt contains finance which receives the highest priority when repaying debts. As mentioned above, it usually includes secured loans and debt backed by collateral. Senior debt lenders also get regular interest and principal payments on their loans. For the lender, this form of debt involves lower risk than junior or subordinated debt.

Junior debt

Junior debt falls behind senior debt in the repayment position. Usually, it includes unsecured debt that involves higher risks for the lender. However, it still receives priority over equity holders. Lenders can compensate for the higher risks with increased interest rates. However, there is no guarantee that they will recover their losses once the senior debt gets paid off after default. Another term used to describe junior debt is subordinated debt.

How does Seniority Ranking work?

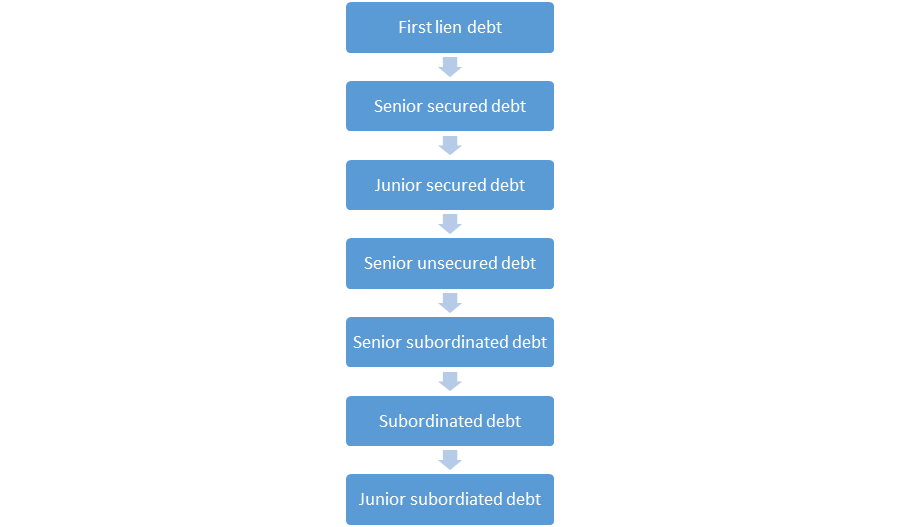

Seniority ranking follows a specific ordering system for debts. Usually, secured debt receives the highest priority. Within these debts, first lien debts come first. Next, come senior secured debts. Finally, junior secured debts get repaid.

After repaying secured debts, unsecured debts get paid. Within these, senior unsecured debts receive the highest priority, followed by senior subordinated debts. Once they get paid, subordinated and junior subordinated debts receive the lowest priority. Overall, the seniority ranking follows the following order.

Conclusion

Companies obtain debt from several sources. If a company defaults on these debts, they get repaid based on the seniority ranking. This ranking represents the order of repayment of different loans. Usually, secured loans receive the highest priority, followed by unsecured loans. Senior debts within these also get repaid before junior or subordinated debts.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum