Credit value adjustment (CVA) is a financial concept used to account for the potential loss in value of a portfolio due to counterparty credit risk. Essentially, CVA reflects the difference between the risk-free portfolio value and the true portfolio value, considering the possibility of counterparty default. It’s a critical component in derivative pricing, especially in over-the-counter transactions, where parties are exposed to credit risk.

Reference [1] generalized the CVA concept and developed a bilateral CVA. It also extended the Hull and White hazard rate model to incorporate default correlation. The authors pointed out,

This paper has developed a counterparty credit risk adjustment model to value OTC financial derivatives. The proposal comprises a bilateral CVA with WWR and dependency between the defaults of the entities involved, based on the Hull-White model (2012) which incorporates the hazard rate as an exponential function dependent on the value of the portfolio.

…

When applying the model to obtain the fair value of an IRS, the results demonstrate that the bilateral CVA with WWR increases and, as a consequence, the fair value of the swap decreases when the dependency between the entities’ de-faults is considered. Here, Monte Carlo simulation has been used to determine the CVA and the fair value of the swap. The relationship between these magnitudes for the two models analyzed was found to be the same for the ten sets of simulations performed.

In short, the paper developed a bilateral CVA and applied it to price an interest-rate swap. Its important finding is that the default correlation increases the CVA value.

Does it intuitively make sense?

Let us know what you think in the comments below or in the discussion forum.

References

[1] Merche Galisteoa, Isabel Morilloa and Teresa Preixensa, CVA with wrong-way risk and correlation between defaults: An application to an interest rate swap, 2023 – Vol. 1 – n.º 3 – Artículo 2

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

RBC says these worrying indicators are worth keeping an eye on

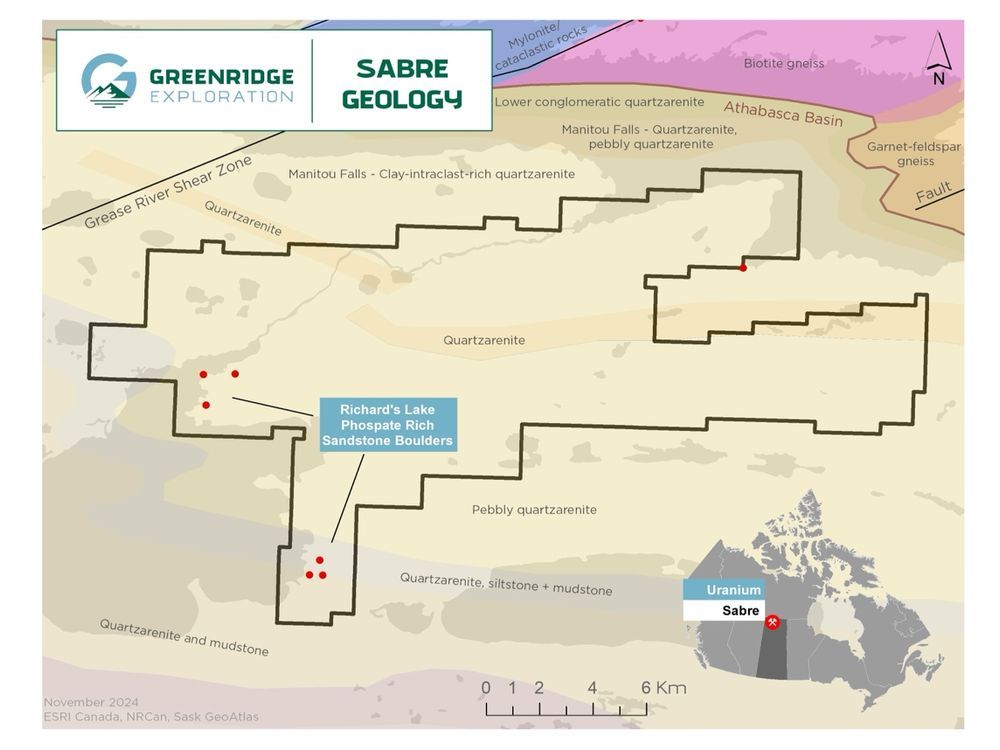

VANCOUVER, British Columbia, March 13, 2025 (GLOBE NEWSWIRE) — Greenridge Exploration Inc. (“Greenridge” or the “Company”) (CSE: GXP | FRA: HW3 | OTCQB: GXPLF), is pleased to announce the engagement of Expert Geophysics Surveys Inc. (“EGS”) to carry out a helicopter-borne Mobile MagnetoTellurics System (“MobileMT”)…

VANCOUVER, British Columbia, March 13, 2025 (GLOBE NEWSWIRE) — MAX Power Mining Corp. (CSE: MAXX; OTC: MAXXF; FRANKFURT: 89N) (“MAX Power” or the “Company”) is pleased to announce that it has engaged Ms. Monita Faris as the Company’s new Corporate Secretary. Based in Vancouver, Ms.…

The order replenishes existing SKUs, and NEXE is working on new blends for EKOCUPS to enhance its product offerings WINDSOR, Ontario, March 13, 2025 (GLOBE NEWSWIRE) — NEXE Innovations Inc. (“NEXE”, the “Company”, “we” or “our”) (TSX.V: NEXE) (Frankfurt: NX5) (OTC: NEXNF), a compostable and…

Plug penetrates the industrial supplier market with new agreement by demonstrating a sustainable option to lead acid batteries SLINGERLANDS, N.Y., March 13, 2025 (GLOBE NEWSWIRE) — Southwire, a leading North American manufacturer of wire and cable, will tap Plug Power Inc. (NASDAQ: PLUG), a global…