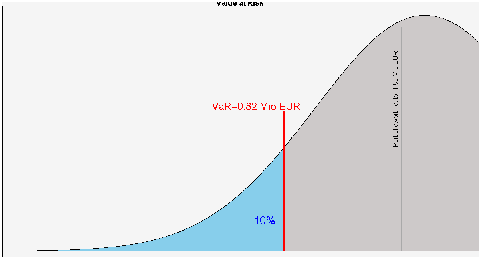

Value at Risk (VaR) is an important risk measure that large financial institutions use for managing the risks and allocating capital. Wikipedia defines VaR as follows:

Value at Risk (VaR) is a measure of the risk of investments. It estimates how much a set of investments might lose, given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses.

For a given portfolio, time horizon, and probability p, the p VaR can be defined informally as the maximum possible loss during the time if we exclude worse outcomes whose probability is less than p. This assumes mark-to-market pricing, and no trading in the portfolio.

Bloomberg recently reported that the combined VaR of the six largest US banks has decreased from $1 billion in 2009 to $279 million. Does this mean that we have much less risk now than before?

Not so if we adjust for the decreasing trend in volatility

What if we strip it out to get a sense of whether risk-taking has really declined, independent of the broader market? The result won’t be perfect, 3 but it should give us a rough idea.

It indicates that, relative to the broader market, the banks’ trading operations are only about 25 percent less risky than they were in 2009 — and have actually become a bit riskier over the past year. Read more

In a similar context, Peter Guy pointed out that, generally speaking, risk models are vulnerable because they were developed and tested in a market environment that can change in the future

… risk models are vulnerable because a decade of zero interest rates have never occurred before in financial and economic history. No one possesses accurate historical data to predict the future. And quantitative models and algorithms heavily depend on historical data for forecasting risk.

“There are no models that are able to accurately capture the effect of rising interest rates. You need to reach back to the period before quantitative easing began,” Read more

So what are the solutions?

One solution is to develop stress scenarios, then use them to calculate probability-weighted, forward-looking risk measures. Additionally, we can implement other VaR variants that better account for the tail risks.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum