Last week, Bloomberg presented a fascinating story about Mexico’s secretive oil hedging program. We noted that while it was designed as a hedge, the Mexican government has made money consistently with it.

If anything, recent results have made the Mexican government look especially good. The country earned $6.4 billion in 2015 and $2.7 billion in 2016 [and $5.1 billion in 2009]. Read more

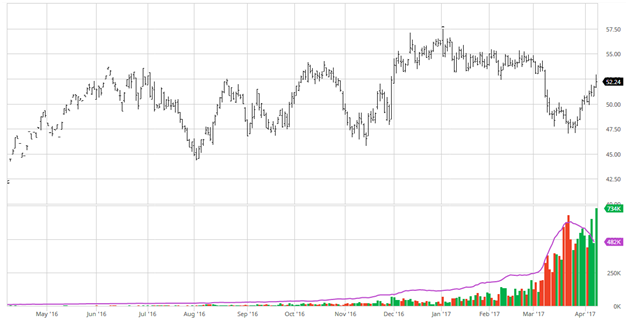

Crude Oil May future. Source: barchart.com

On the opposite side, Florida utilities have lost money consistently with their hedging programs. Susan Salisbury reported:

In the past 15 years, Florida’s four investor-owned utilities have lost close to $7 billion due to natural gas hedging programs. That’s because the utilities have purchased much of their gas through hedging contracts at locked-in prices rather than on the open market, and gas prices have declined for the most part. Read more

So the question is: to hedge or not to hedge?

We think that the Mexican government’s and Florida utilities’ hedging programs are 2 extreme cases. We always believe that it’s important for commodity producers to hedge the commodity prices and not to speculate. After all, hedging is a form of insurance.

In this regard, a post on bizcommunity.com pointed out:

… not hedging your crop in today’s extremely volatile market is reckless business practice.

The post discusses hedging agricultural products, but the arguments apply to any commodity. It also suggested a sensible hedging program:

“One can’t lose using a hedging strategy. Especially if, as we always recommend, you hedge only one-third of your crop. The ideal scenario is to sell one-third of the crop on a pre-season minimum price contract and one-third on a pre-season fixed price contract. One can then keep the last third for the end of season premiums, without risking losing good income from the main part of the crop. Read more

Designing an effective hedging program is not easy. It requires a deep knowledge of the hedging instruments that are often quite complex. It also requires a thorough understanding of different hedging techniques and strategies. A specialist can help implement a robust hedging program in this regard.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum