Follow us on LinkedIn

The VIX, developed by Robert Whaley in 1993, represents implied volatility with a fixed 30-day maturity and is quoted annually. Originally designed as a model-based IV index on the S&P 100, its purpose is to serve as a foundation for trading volatility derivatives. These derivatives are valuable for hedging portfolios against the risk associated with fluctuations in volatility. Later, CBOE created a model-free version of the VIX.

Reference [1] employed the model-free approach on a basket of individual stocks and computed the VIX across different intraday timeframes: 1 minute, 10 minutes, and 60 minutes. The authors then utilized the intraday VIX values of these equities to explore the relationship between returns and volatility. They pointed out,

We use our estimates to analyze the intraday return volatility–relationship using 1, 10, and 60 min data. We find a negative relationship between returns and volatility changes, which is significant for most of our sample stocks when considering contemporaneous returns. The stronger the link, the lower the frequency. For lagged returns, the effect is less evident. Quantile regressions reveal a clear inverted U-shaped pattern when considering contemporaneous returns, which again becomes less evident for lagged returns. These findings indicate that behavioral biases rather than the fundamental theories of leverage or volatility-feedback effects cause the asymmetric link between returns and volatility.

…Moreover, the derived time series of intraday MFIV measures will allow us to assess the imminent effect of news on volatility relying on time series models. They also offer the opportunity to address the impact of attention and sentiment measures at such high frequencies.

In short, the negative relationship between returns and volatility exists in individual stocks too. It originates from investors’ behaviors rather than being attributed to leverage or volatility feedback, as previously believed.

Let us know what you think in the comments below or in the discussion forum.

References

[1] Peter, Franziska and Haas, Martin G., Implementing Intraday Model-Free Implied Volatility for Individual Equities to Analyze the Return-Volatility Relationship, J. Risk Financial Manag. 2024, 17(1), 39

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

GENEVA, March 31, 2024 (GLOBE NEWSWIRE) — Ambassador Nobel C.K. McWhorter & McWhorter Family Trust announce its strategic collaboration with Vacheron, an epitome of luxury watchmaking and the world’s oldest watch manufacturer in continuous operation. This partnership celebrates Vacheron’s unparalleled dedication to artisanal heritage, excellence,…

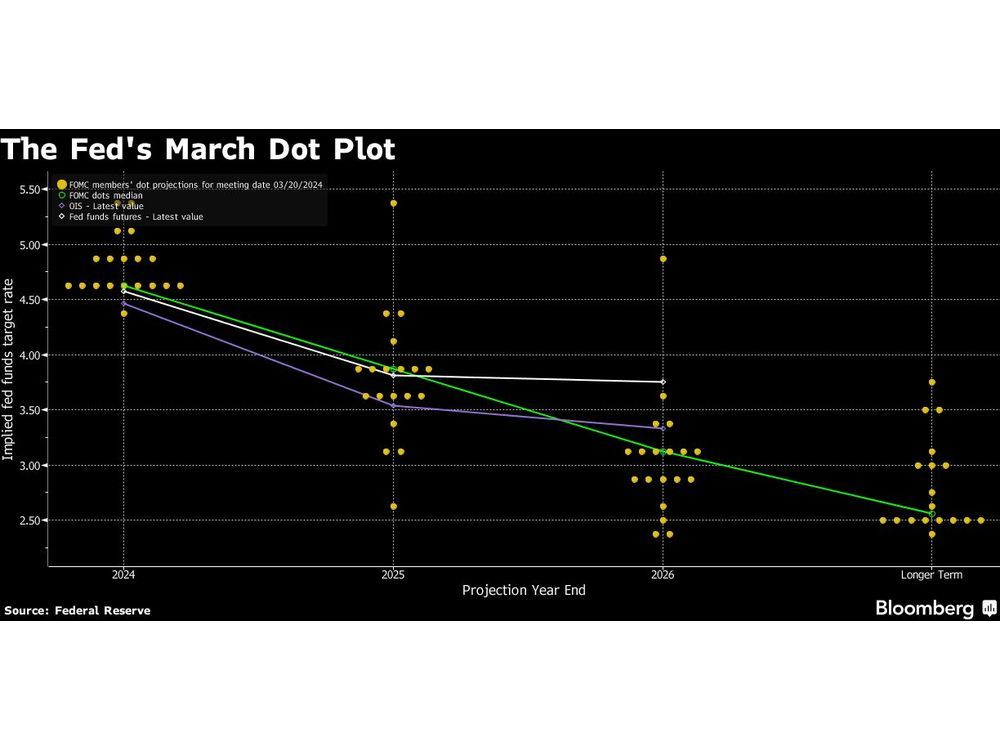

Equity markets in Asia look set to open higher as the Federal Reserve reiterated it’s in no rush to cut interest rates and will await more evidence that inflation is under control.