Follow us on LinkedIn

In a previous post, we presented a methodology for pricing European options using a closed-form formula. In this installment, we price these options using a numerical method. Specifically, we will use Monte Carlo simulation.

Recall that,

- A call option gives the buyer the right, but not the obligation to buy an agreed quantity of the underlying from the seller at a future time for a given price. The payoff of the call option at expiration is max(ST-K,0),

- A put option gives the buyer the right, but not the obligation to sell an agreed quantity of the underlying to the seller at a future time for a given price. The payoff of the put option at expiration is max(K -ST,0),

where ST denotes the stock price at expiration and K is the strike price.

To price these options, we first simulate the price paths using the following Stochastic Differential Equation:

![]() where

where

- St is the stock price at time t,

- σ denotes the stock volatility,

- µ is the drift which equals the risk-free rate, and

- dWt represents the standard normal random variable.

The simulation is carried out until the options’ maturity. We then apply the terminal payoff functions and calculate the mean values of all the payoffs. Finally, we discount the mean values to the present and thus obtain the option values. For a more detailed presentation of the Monte Carlo method, see Reference [1].

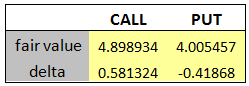

The picture below shows the call and put option prices using 100000 simulations. All other parameters are the same as in the previous post.

![]()

We compare the above results to the ones obtained by using a third-party software and notice that they are in good agreement.

In the next installment, we will present a methodology for pricing American options using Monte Carlo simulation.

References

[1] Glasserman, Paul; Monte Carlo Methods in Financial Engineering, Springer; 2003

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

Meta rolled back January 6-era restrictions on former President Donald Trump's social media accounts ahead of the Republican National Convention.

June saw 75 filings, up from 62 in May and above the pandemic-era peak of 74 in July 2020, according to S&P Global Market Intelligence.

Credit markets are breathing a sigh of relief after inflation data showed price pressures are cooling broadly, but a weakening economy poses fresh risks to corporate debt.

Terrific work!