With the VIX being so low, many investors believe that now is the time to go long volatility. This belief mainly stems from the mean reversion property of the VIX. However, we should note that

- The speed of mean reversion in the low volatility regime is slower than it is in the high volatility one

- The clustering of volatility is also different in low/high volatility regimes

- Spot VIX is not tradable. Therefore, we should use VIX ETFs or futures that have already discounted the mean reversion property of spot VIX, to a certain degree.

The above points make the development of a long volatility trading/hedging system difficult.

A recent research report by Macro Risk Advisors (MRA) compared two trading strategies for going long volatilities. The rules are as follows:

- Buy VXX when the spot VIX is low

- Buy VXX when the spot VIX was low in the previous month and now is rising

Their results show that buying volatility when the VIX is low is a losing strategy, while buying volatility when the VIX is increasing is a winning strategy.

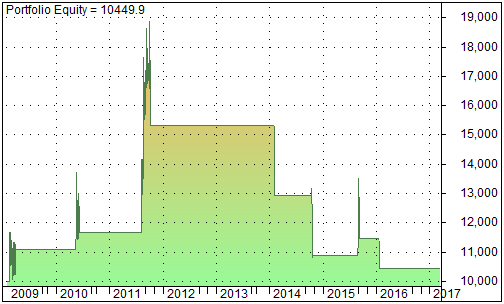

Last year, we published a VIX trading system based on the Roll Yield. The graph below shows the equity line of going long VXX when the volatility term structure goes from contango to backwardation (length of moving average is 10 days), i.e. when the VIX is increasing.

Equity line for the Roll Yield strategy, long only.

As we can see, our system did not lose money. This is consistent with the results presented in the MRA’s report. However, it also pointed out that results of the simple backtest are not enough to conclusively say that their trading strategies are robust, but it clearly illustrates the risk of buying volatility when it’s low.

Similarly, in our own test, the sample size is too small, so we cannot say that we have developed a reliable system. But this and other (not shown) research results, together with MRA’s backtests, can provide an evidence that just buying VXX or VIX futures when volatility is low is not a good strategy.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum