Last week, after the French election, the VIX plummeted and started its journey into the low-volatility regime again. Consequently, volatility selling strategy began gaining traction. However, FT.com published a warning

Jim Keohane, the chief executive of the Healthcare of Ontario Pension Plan, compares selling volatility to picking up dimes in front of a steamroller. “You are not getting paid a lot in the current market for the potential to get killed. That can happen very quickly,” he warns. Read more

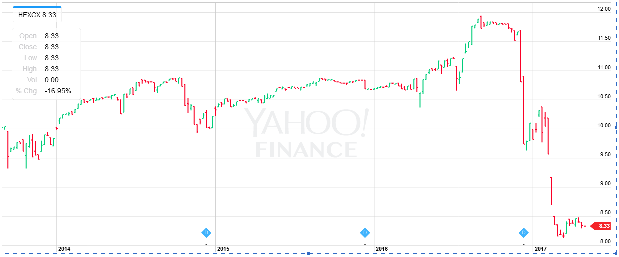

The chart below shows the price of Catalyst Hedged Future Strategy, a fund specialized in shorting volatility

Catalyst Hedged Future Strategy price as of May 2 2017. Source: Yahoo finance

As we can see from the chart, shorting volatility is indeed a game of picking up dimes in front of a steamroller, i.e. when we win, we win small, but when we lose, we lose big.

But why is volatility so low?

We provided some explanations in our previous posts

Why Is VIX So Low and What To Do About It?

Now Is The Time to Hedge, But The Cost of Insurance Can Be Expensive

Recently, Vineer Bhansali provided more clarifications. According to him, the low volatility is due to the facts that

- Realized volatility is low, resulting in a low implied volatility,

- Inflow into equities is increasing,

- Popularity of shorting volatility through VIX ETNs is rising,

- Investors are shorting volatility through options,

- Market makers and sell-side institutions are delta hedging their inventories.

Of all the reasons above, which one is the most important?

We don’t know the exact answer yet. But what we do know now is that it’s very difficult to time the market turn, therefore it’s important to protect our portfolios by using some inexpensive hedges. The author also pointed out:

In most cases historically, it has paid to replace outright risk with cheap options, or to perhaps build in some cheap downside protection, even without knowing accurately the timing of the correction. While it is almost impossible to time the corrections, it is equally unwise to be superstitiously short volatility when the dissonance between common sense and market behavior becomes so wide. Read more

We are in agreement with him in this regard.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

Read excerpts from columns that appeared in April, May and June 2024 in FP Comment. This in the second instalment in a series

For many companies in the EV space, the biggest question is what it will take to reverse the declining momentum and regain solid footing