Follow us on LinkedIn

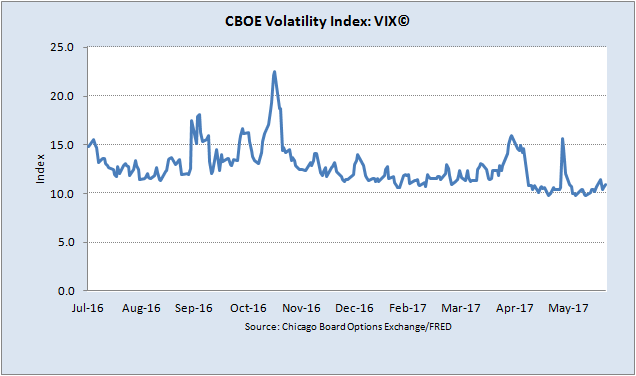

Last week, JPMorgan issued a report on the state of quantitative investing and the current low volatility environment. The report pointed out that despite the political uncertainties (Comey testimony, UK elections, ECB, geopolitical uncertainty, Qatar etc.), the volatility remains subdued. In fact, in the last 20 years the VIX closed lower than 10 for a total of 11 days, and 7 of those days were in the past month.

VIX as at June 16, 2017

The report also provided some explanations as why the VIX is so low:

- Belief that the macro environment is very benign

- Macro decorrelation: low correlations (driven by quant flows, sector and thematic trading) are temporarily reducing volatility by 2-4 points

- Massive supply of volatility through yield generation products and strategies. It is estimated that supply from yield seeking risk premia strategies grew by ~$1Bn vega (~30% of the S&P 500″ options market)

- Low realized volatility resulting in a low implied volatility

None of the reasons above is surprising, and they are consistent with arguments presented in the post entitled Why is Volatility so Low?

What we find interesting is that retail traders keep shorting the VIX in this low volatility environment

[A] Boca Raton, Florida, day trader says he has made $USUS53,000 since the start of the year by effectively shorting the CBOE Volatility Index, nicknamed the VIX. That includes a white-knuckle day on May 17, when the VIX spiked 46 per cent following reports that President Donald Trump had pressured former FBI Director James Comey to drop an investigation into former national security advisor Michael Flynn. Read more

However, we rarely hear about investors who lost most of their money when the volatility exploded.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

Citigroup on Friday posted second-quarter results that topped expectations for profit and revenue on a rebound in Wall Street activity.

JPMorgan Chase on Friday posted second-quarter profit and revenue that topped analysts' expectations as investment banking fees surged 52% from a year earlier.

NEW YORK — Announcement of Mesabi Trust Distribution The Trustees of Mesabi Trust (NYSE:MSB) declared a distribution of thirty cents ($0.30) per Unit of Beneficial Interest payable on August 20, 2024 to Mesabi Trust Unitholders of record at the close of business on July 30,…