Follow us on LinkedIn

The low volatility anomaly in the stock market refers to the phenomenon where stocks with lower volatility tend to provide higher risk-adjusted returns compared to their higher volatility counterparts, contrary to traditional financial theories. Various explanations have been proposed for this anomaly, including investor behavioral biases, such as overestimating the risks associated with volatile stocks and underestimating the risks of stable, low-volatility stocks. Additionally, low-volatility stocks may attract more conservative investors seeking stability, thereby increasing demand and driving prices higher.

The momentum anomaly in the stock market refers to the tendency of assets that have performed well in the past to continue performing well in the future, and those that have performed poorly to continue performing poorly. Research has shown that momentum strategies can generate abnormal returns over long periods, indicating that the market may not efficiently incorporate past information into asset prices.

Reference [1] combines the low volatility anomaly with the momentum anomaly and examines whether the low volatility anomaly can enhance risk-adjusted returns in momentum-sorted portfolios. The authors pointed out,

Our results show that strategies incorporating both momentum and low volatility signals give simultaneous positive exposure to well-known factors such as value and profitability. The returns are consistent over time and even more pronounced in the later subsample, as indicated by higher robust Sharpe Ratios. Whereas our findings indicated that the plain momentum portfolio exhibits the highest robust Sharpe Ratio, for investors wishing to implement a long-only strategy, the DS strategy that first sorts stocks with respect to the momentum signal (e.g. winner stocks), and then sorts stocks with respect to the low-volatility signal appears to be superior to other strategies.

In short, the double-sorted momentum-first trading strategy outperforms other strategies and provides superior risk-adjusted returns.

Note that the research has been conducted in the Nordic stock markets.

Let us know what you think in the comments below or in the discussion forum.

References

[1] Klaus Grobys, Veda Fatmy and Topias Rajalin, Combining low-volatility and momentum: recent evidence from the Nordic equities, Applied Economics, 2024

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

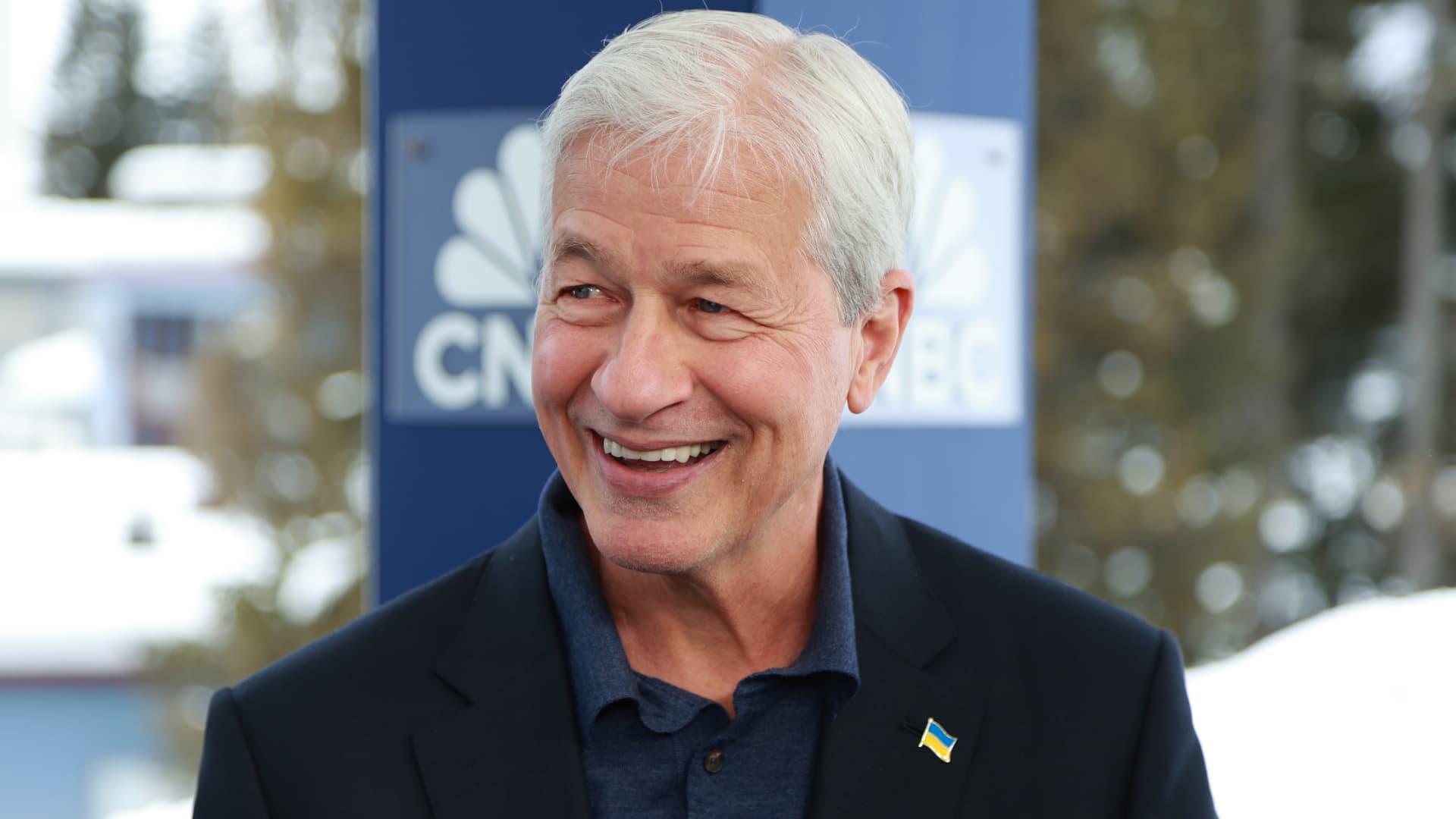

JPMorgan Chase will be watched closely for clues on how banks fared at the start of the year.

From new shows like "Fallout" and "The Sympathizer" to true crime docs like "What Jennifer Did," here are all the best things to watch this weekend.

BlackRock saw its assets under management grow by $1.4 trillion in 12 months as client funds poured in and markets performed well.

Jaime Muñoz left the Silicon Valley start-up hub for a fintech job in Chicago, hoping to get in early at a company and build wealth.

TORONTO — VerticalScope Holdings Inc. (“VerticalScope” or the “Company”) (TSX: FORA) announced today that the Company’s first quarter 2024 financial results will be released after the market close on Tuesday, May 7, 2024. Management will host a conference call and webcast to discuss the Company’s…