Follow us on LinkedIn

The sell-off in the high yield bond Exchange Traded Funds space last month reminds us of an important risk factor: liquidity.

But what exactly is liquidity risk? According to Aleksander Kocic, derivatives strategist at Deutsche Bank AG,

Liquidity transforms the risk of default (the ability that the debtor may not be able to pay back his debt) into the risk that the securities representing the debt find no purchasers … today’s era of booming bond sales has an eerie parallel to the subprime crisis of the mid-2000s. Back then, low interest rates spurred an intense search for yield that culminated in investors purchasing risky home loans in the form of securitized and salable bonds. Such securitizations had the benefit of convenience as investors could buy and sell specific exposures comprising hundreds of thousands of individual home loans.

The forced unwind of leverage was responsible for the transformation of conditional insolvency to unconditional illiquidity. Read more

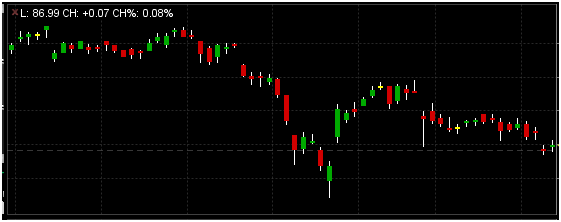

HYG High Yield Bond ETF as at Dec 22, 2017. Source: Interactivebrokers

With the recent proliferation of Exchange Traded Funds, there is no surprise that there exist ETFs that are supposedly designed to offer “liquidity transformation”, i.e. they would allow investors to buy and sell illiquid debt instantaneously. However, liquidity risk is still there, and those ETFs can actually exacerbate the risk.

As for now, an important question to ask is: was the liquidity risk priced in? According to John Davi on Valuewalk, it is not, and 2018 can see an increase in liquidity risk.

The markets, however, trade on the margin and 2018 will begin to see liquidity decline in the US. The Fed has started to raise rates, wants to hike more, and quantitative tightening will further reduce liquidity. The repercussions are quite significant – especially on the margin.

It is not surprising that liquidity sensitive asset classes such as US high yield credit, US Small Caps, and Japan corrected in October/November. Historically, liquidity in capital markets starts to decline in Q4 as banks begin to wind down their balance sheet ahead of year end. Plus, we have the potential for another Fed rate hike in December. The “liquidity based correction” was likely in anticipation of both events. Read more

If liquidity deteriorates, portfolio managers can use liquid credit and/or volatility derivatives to hedge the risks.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

Meta rolled back January 6-era restrictions on former President Donald Trump's social media accounts ahead of the Republican National Convention.

June saw 75 filings, up from 62 in May and above the pandemic-era peak of 74 in July 2020, according to S&P Global Market Intelligence.

Credit markets are breathing a sigh of relief after inflation data showed price pressures are cooling broadly, but a weakening economy poses fresh risks to corporate debt.