Time series analysis is an important subject in finance. In this post, we are going to apply a time series technique to a financial time series and develop an investment strategy. Specifically, we are going to use moving averages to trade volatility Exchange Traded Notes (ETN).

Moving averages are used on financial time series data to smooth out short-term noises and identify longer-term trends. We apply them to VXX, a volatility ETN. Note that VXX

- Launched in 2009

- Enables investors to bet on the size of swings in the S&P 500 Index (SPX)

- Used by individual investors and hedge fund managers alike

- Peaked at $2 billion under management in Feb. 2018, now $800 million

- Structured as a debt instrument with a maturity date of Jan. 30, 2019

- Was replaced by the VXXB, which has other features. Read more

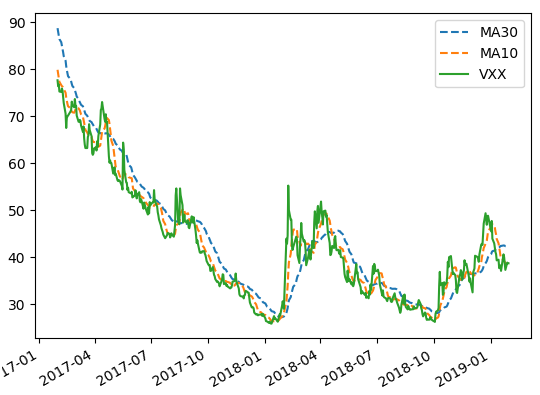

The trading rules are as follows [1],

If 10-day Moving Average (MA10) < 30-day Moving Average (MA30) Sell Short

If 10-day Moving Average (MA10) >= 30-day Moving Average (MA30) Cover Short

The system is implemented in Python. Graph below shows the MAs and VXX for the last 2 years.

VXX and Moving Averages

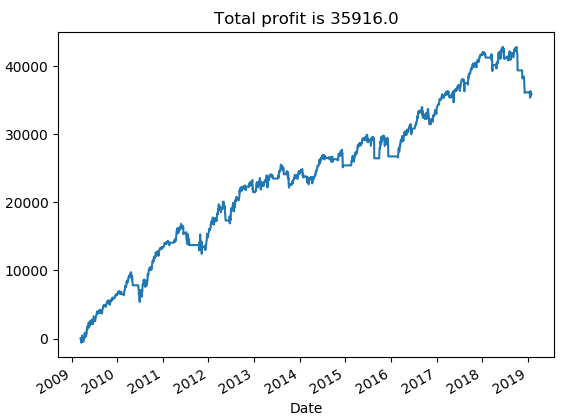

The position size is $10000; leverage is not utilized, and profit is not compounded. Graph below shows the equity curve for the trading strategy from January 2009 to January 2019.

Equity curve for VXX trading system

The strategy is profitable, and the moving averages help identify the trends.

References

[1] L. Connors, Buy the Fear, Sell the Greed: 7 Behavioral Quant Strategies for Traders, TradingMarkets Publishing, 2018

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum