Follow us on LinkedIn

Historical volatility is a prevalent statistic used by options traders and financial risk managers. Historical volatility measures the past fluctuations in the price of an underlying asset. When there is a rise in historical volatility, a security’s price will also move more than normal. At this time, there is an expectation that something will or has changed. If the historical volatility is dropping, on the other hand, it means any uncertainty has been eliminated, so things return to the way they were.

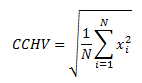

There are various types of historical volatilities such as close to close, Parkinson, Garman-KIass, Yang-Zhang, etc. We implemented the closed-to-close historical volatility in a calculator. The close-to-close historical volatility (CCHV) is calculated as follows,

where xi are the logarithmic returns calculated based on closing prices, and N is the sample size. In this example, N=22, the average number of trading days in a month.

Input

Use the dropdown menu highlighted in yellow to choose the stock.

Output

The calculator returns the following results

- A plot of 22-day rolling historical volatility

- A plot of the stock price

- 1-year historical volatility

Check out other finance calculators on our website.

Let us know what calculator you want us to develop in the comment section below.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

Prime Minister Keir Starmer’s promise to “get Britain building again” will quickly face a shortage of skilled workers in the very industries he’s hoping will power the turnaround.