Follow us on LinkedIn

In the previous posts entitled

Where are the Cheap Hedges for Equity Portfolios?

Now Is The Time to Hedge, But The Cost of Insurance Can Be Expensive,

we outlined some solutions for finding inexpensive hedges in this low volatility environment. In this post we will continue to explore some more opportunities, and elaborate on additional risks that we have to take.

Buying far-dated options

Some experts believe that buying far-dated options is a good hedge right now, because we would minimize the hedging cost due to options time decay. Recently Dani Burger et al. of Bloomberg reported:

However, moving further out on the VIX curve there’s still a bid for September futures. And it’s one that Macro Risk Advisors’ Pravit Chintawongvanich likes. On the long-end, investors can buy contracts that are less exposed to decay from time and more exposed to volatility risks, he said.

“Over the next four-to-five months, there is a good chance to monetize these long-dated VIX futures,” Chintawongvanich wrote in a note to clients Monday. Read more

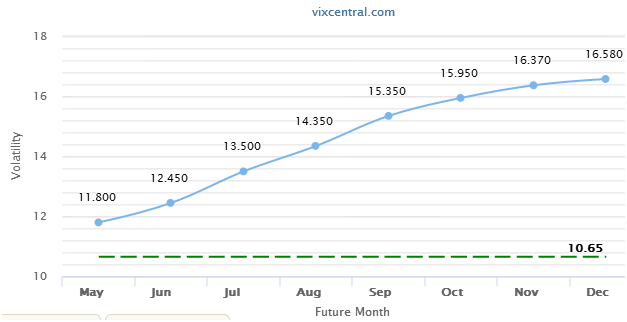

VIX futures as at May 16, 2017. Source: vixcentral.com

Note, however, that if investors buy far-dated options, they will then pay for not only the volatility risk premium, but also the term structure premium. In other words, there is no free lunch here.

Cross-asset hedging

Investors can use other highly correlated asset for hedging their portfolios. For example, they can buy puts in the emerging market ETFs.

“In spite of the ongoing correction in the commodity complex and emerging market equities’ historically strong correlation to commodities, investors continue to push emerging market equites higher. Positioning recently jumped to 5 year highs, and the MSCI EM Index posted its largest volatility-adjusted outperformance vs. commodities in the past 10 years. While EM equities appear increasingly vulnerable to a commodity-induced near term correction, the volatility market remains extremely sanguine with short-dated implied vol rarely trading cheaper and EEM puts screening as the best equity hedge against commodity drawdowns. Hence we believe EEM puts are significantly undervalued to hedge or capture potential emerging market equity downside. For instance, a long EEM Aug 39.5/37 put spread costs indicatively 66c (1.6%), with comparable put spreads cheaper less than 1% of the time in the past 8 years.” Read more

Similarly, as suggested by the Bloomberg article above, investors can also buy Euro or Sterling options.

Other potential hedges are

- Buying defensive stocks

- Buying calls instead of owning stocks

However, we note that if investors use the cross-asset hedging technique, they take on additional risks, of which correlation is the most important. Other additional risk factors are: cross-asset volatilities, sector risks, excessive risk premium.

As we can see, with some critical thinking, we can come up with ideas for finding cheaper hedges. However, prudent investors should evaluate additional risks when employing such techniques.

Further questions

What's your question? Ask it in the discussion forum

Have an answer to the questions below? Post it here or in the forum

The Princess of Wales will present the trophy to either last year's winner, Carlos Alcaraz, or seven-time Wimbledon champion, Novak Djokovic.